Wall Street Expects Double-Digit Price Surge in AAL Stock

American Airlines (AAL) has received a consensus “buy” rating from analysts polled by Reuters.

Dec. 4 2018, Updated 9:02 a.m. ET

Analysts’ bullish stance

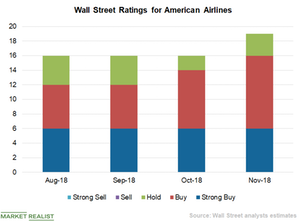

American Airlines (AAL) has received a consensus “buy” rating from analysts polled by Reuters. Analyst ratings began to improve after it reported strong third-quarter results on October 25.

About 84% of analysts have provided bullish recommendations on American Airlines. Six of the 19 analysts tracking the stock have given it “strong buy” ratings, while ten have given it “buy” ratings. Only three analysts have given it “hold” ratings. Analysts’ target price of $47.37 on the stock represents a potential ~18% rise from its current price of $40.16.

American Airlines has received sharp upward revisions to its EPS estimates for 2018 and 2019. The mean estimate for its 2018 EPS increased to $4.54 from $4.24 on October 24. Its 2019 EPS estimate improved to $5.31 from $5.05.

Peers’ ratings

Wall Street analysts are bullish on the entire airline industry (XTN) and have “buy” recommendations on United Continental (UAL), Southwest Airlines (LUV), and Delta Airlines (DAL).

Six of the 19 analysts tracking United have given it “strong buy” ratings, four have given it “buy” ratings, and the remaining nine have given it “hold” ratings. Analysts’ target price of $103.06 represents a potential 6.6% rise from its current price of $96.70.

Six of the 21 analysts tracking Southwest have given it “strong buy” ratings, seven have given it “buy” ratings, seven have given it “hold” ratings, and one has given it a “sell” rating. Its target price of $62.22 represents a potential 13.9% increase from its current price of $54.61.

Eight of the 20 analysts tracking Delta have given it “strong buy” ratings, 11 have given it “buy” ratings, and one has given it a “hold” rating. Its target price of $68.53 reflects a potential 12.9% rise from its current price of $60.71.