The Major Factors Driving Netflix’s Cost of Revenues

Netflix’s (NFLX) revenues grew at a three-year CAGR of 29.0% to $11.7 billion in 2017.

Oct. 1 2018, Updated 7:30 a.m. ET

A look into Netflix’s revenues and cost of revenue growth

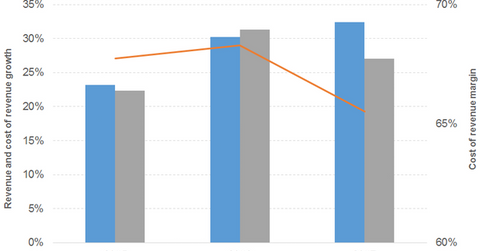

Netflix’s (NFLX) revenues grew at a three-year CAGR (compound annual growth rate) of 29.0% to $11.7 billion in 2017. Its revenue growth picked up from 23.0% in 2015 to 30.0% and 32.0% in 2016 and 2017, respectively. Higher global streaming memberships and average monthly revenues drove the revenue growth for these years.

How have Netflix’s profit margins changed over the years?

Netflix’s cost of revenues increased by 22.0%, 31.0%, and 27.0%, respectively, in 2015, 2016, and 2017. These costs rose at a three-year CAGR of 27.0% in 2017 to $7.7 billion. Streaming content expenses and streaming delivery expenses drove the increase in expenses. These costs comprised 68.0% of the company’s revenues between 2014 and 2016 compared to 66.0% in 2017.

Strength in Amazon’s revenues led to gross profit growth of 25.0%, 28.0%, and 44.0%, respectively, in 2015, 2016, and 2017. Its gross profit increased at a three-year CAGR of 32.0% to $4.0 billion in 2017. Its gross margin rose slightly from 32.0% between 2014 and 2016 to 34.0% in 2017.

Amazon’s operating expenses rose 40.0% in 2015 compared to 29.0% and 32.0% in 2016 and 2017, respectively. These expenditures increased at a three-year CAGR of 33.0% to $3.2 billion in 2017.

Technology and development expenses declined slightly in 2017 as a proportion of revenues. Its general and administrative expenses as a percentage of revenues remained the same in 2016 and 2017. The company’s expenditures comprised 25.0% of its revenue in 2014 compared to 28.0% in 2015 and 27.0% in both 2016 and 2017.

Operating costs

Netflix’s rising operating costs partially negated the effect of strength in revenues and gross profit. Its income from operations declined by 24.0% in 2015 before gaining 24.0% and 121.0% in 2016 and 2017, respectively. Its income from operations grew at a three-year CAGR of 28.0% to $0.8 billion in 2017.

The company’s operating margin declined from 7.0% in 2014 to 4.0%–5.0% in 2015 and 2016 and remained at 7.0% in 2017. Interest and other expense constituted 1.0%–3.0% of revenues during this timeframe.

These factors translated into a net income decline of 52.0% in 2015 before gaining 71.0% and 199.0% in 2016 and 2017, respectively. Netflix’s net income has grown at a three-year CAGR of 35.0% to $0.6 billion. Its net margin declined from 4.0% in 2014 to 2.0% in 2015 and 2016 and remained at 5.0% in 2017.

Netflix’s EPS fell by 53.0% in 2015 before increasing by 72.0% and 191.0% in 2016 and 2017, respectively. Netflix’s EPS has grown at a three-year CAGR of 33.0% to $1.30 in 2017.

Netflix’s higher operating expense margin has negated its gross margin growth, translating into low operating and net margins compared to Facebook (FB), Apple (AAPL), and Alphabet (GOOG). Facebook, Apple, and Alphabet had net margins of 39.0%, 21.0%, and 20.0%, respectively, in 2017. Amazon (AMZN) and Netflix (NFLX) had net margins of 1.0% and 5.0%, respectively, in 2017.