The Gap between Alphabet’s Gross and Other Profit Margins

Alphabet’s EPS grew at a three-year CAGR of 8.0% to $32.30 in 2017.

Oct. 2 2018, Updated 7:30 a.m. ET

Analyzing Alphabet’s profit margins

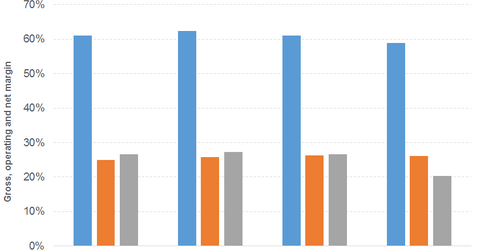

Alphabet’s (GOOG) rising revenue costs partially offset its higher sales. As a result, its gross profit increased at a three-year CAGR (compound annual growth rate) of 17.0% to $65.3 billion in 2017. Its gross profit improved by 16.0% in 2015 and 18.0% in both 2016 and 2017. However, the company’s gross margin declined from 61.0% in 2014 to 59.0% in 2017.

Operating expenses

Alphabet’s operating expenses have increased at a three-year CAGR of 15.0% to $36.4 billion in 2017. Research and development, sales and marketing, and general and administrative expenses were the main components of the company’s operating expenses and remained consistent as a proportion of its revenues.

These expenditures rose by 15.0%, 14.0%, and 16.0%, respectively, in 2015, 2016, and 2017. They used up 36.0% of the revenues in 2014 compared to 33.0% in 2017.

Revenue and gross profit growth translated into its three-year CAGR of 21.0% in income from operations. Alphabet’s income from operations grew by 17.0%, 23.0%, and 22.0%, respectively, in 2015, 2016, and 2017. Its income from operations totaled $28.9 billion in 2017. The company’s operating margin increased slightly from 25.0% in 2014 to 26.0% in 2015, 2016, and 2017.

Alphabet’s non-operating expenses ate away 2.0% of revenues in 2017. The rise in these expenses resulted from fine imposed by the EC (European Commission) in June 2017. The EC imposed a $2.7 billion penalty on Alphabet for the infringement of European competition rules via search results and ads.

Net income

The company’s net income rose at a three-year CAGR of 9.0% to $22.5 billion in 2017. Alphabet’s net income had grown by 17.0% in both 2015 and 2016 before declining by 6.0% in 2017. As a result, its net margin dropped from 27.0% between 2014 and 2016 to 20.0% in 2017.

Alphabet’s EPS grew at a three-year CAGR of 8.0% to $32.30 in 2017. Its EPS rose 16.0% in both 2015 and 2016 before falling 6.0% in 2017.

Alphabet’s high gross margins allow it to enjoy higher operating and net margins compared to the other FAANG stocks. Facebook (FB), Apple (AAPL), Amazon (AMZN), and Netflix (NFLX) had gross margins of 87.0%, 38.0%, 37.0%, and 34.0%, respectively, in 2017 compared to Alphabet’s gross margin of 59.0%.