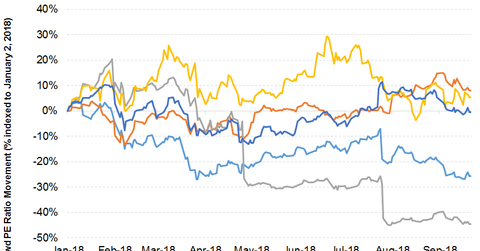

Comparing the Valuations of the FAANG Stocks

Amazon has gained 68.5.0% YTD in stock value. Amazon last traded at a discount of 4.0% to its 52-week high price.

Oct. 2 2018, Updated 10:30 a.m. ET

Projected PE ratios of the FAANG stocks

The FAANG stocks—Facebook, Apple, Amazon, Netflix, and Alphabet—constitute a significant portion of the S&P 500 regarding their market capitalization. The performance of these stocks heavily dominates the index’s performance. We’ll analyze the valuations of the FAANG stocks by their PE (price-to-earnings) ratios on September 21.

Facebook’s (FB) continued strength in revenue and EPS growth has translated into compelling PE ratios for the company. Facebook has projected PE ratios of 22.7x, 19.6x, and 17.2x, respectively, for fiscal 2018, fiscal 2019, and fiscal 2020.

Facebook stock has lost 7.7% in value on a YTD (year-to-date) basis. FB stock has received “strong buy,” “buy,” and “hold” recommendations from 17, 25, and four analysts, respectively. One analyst each issued “sell” and “strong sell” recommendations. Facebook last traded at a discount of 25.0% to its 52-week-high price.

Apple

Apple’s (AAPL) revenue and earnings projections have translated into projected PE ratios of 18.5x, 15.9x, and 14.5x, respectively, for fiscal 2018 ending September 30, fiscal 2019 ending September 30, 2019, and fiscal 2020 ending September 30, 2020. The stock has gained 28.6% and has “strong buy,” “buy,” and “hold” recommendations from 15, 12, and 14 analysts, respectively. Apple last traded at a discount of 5.0% to its 52-week-high price.

Amazon

Amazon’s (AMZN) revenue and earnings growth translated into projected PE ratios of 109.5x, 74.8x, and 50.1x, respectively, for fiscal 2018, fiscal 2019, and fiscal 2020. The stock has “strong buy,” “buy,” and “hold” recommendations from 16, 29, and two analysts. It also has a “sell” recommendation from one analyst.

Amazon has gained 63.8% YTD (year-to-date) in stock value. Amazon last traded at a discount of 7.0% to its 52-week high price.

Netflix

Netflix’s (NFLX) positive revenue and earnings projections have translated into projected PE ratios of 134.3x, 82.5x, and 52.7x, respectively, for fiscal 2018, fiscal 2019, and fiscal 2020. The stock has gained 88.2% YTD and has “strong buy,” “buy,” “hold,” and “strong sell” recommendations from ten, 18, 13, and two analysts, respectively. One analyst issued a “sell” rating. Netflix last traded at a discount of 15.0% to its 52-week-high price.

Alphabet

Alphabet’s (GOOG) growth in revenue and earnings projections have led to projected PE ratios of 29.6x, 24.3x, and 20.7x, respectively, for fiscal 2018, fiscal 2019, and fiscal 2020. The stock has gained 11.4% YTD in stock value and has “strong buy” and “buy” recommendations from two and three analysts, respectively. Alphabet last traded at a discount of 8.0% to its 52-week-high price.