What Are Institutional Investors’ Positions on Celanese?

Second-quarter 13F SEC filings indicate that institutional investors own 95.3% of Celanese’s (CE) outstanding shares.

Sept. 20 2018, Updated 10:31 a.m. ET

Institutional investors’ activities

Second-quarter 13F SEC (U.S. Securities and Exchange Commission) filings indicate that institutional investors own 95.3% of Celanese’s (CE) outstanding shares. Of the 573 institutional investors that hold CE, 231 have increased their positions, 253 have reduced their positions, and 89 have maintained their positions.

Top three holders

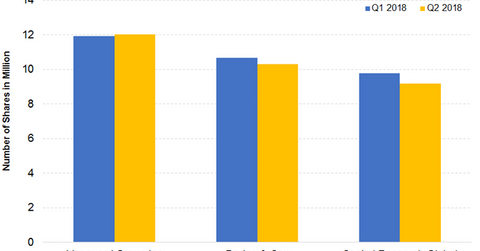

The top three institutional investors account for ~23.1% of CE’s outstanding shares. However, they’re net sellers. The top three investors decreased their total position from 32.56 million shares in the first quarter to 31.48 million shares in the second quarter. Based on the 13F filings, the top three institutional investors’ holdings are as follows:

- Vanguard added ~103,000 shares to its earlier holdings in CE in the second quarter. It now holds 12.02 million shares, which represents ~8.8% of CE’s outstanding shares.

- Dodge & Cox reduced its positions in Celanese, reducing CE’s position from 10.67 million shares in Q1 2018 to 10.3 million shares in Q2 2018.

- Capital Research Global Investors sold ~600,000 shares in the second quarter. According to the latest 13F filings, it has ~9.16 million shares, which represents ~6.7% of CE’s outstanding shares.

Investors can hold Celanese indirectly by investing in the Invesco Zacks Mid-Cap ETF (CZA). CZA has invested 1.3% of its portfolio in CE. The fund also provides exposure to Stanley Black & Decker (SWK), Textron (TXT), and Dover (DOV), with weights of 1.9%, 1.6%, and 1.2%, respectively.