Analyzing Top Utilities’ Free Cash Flow Trends

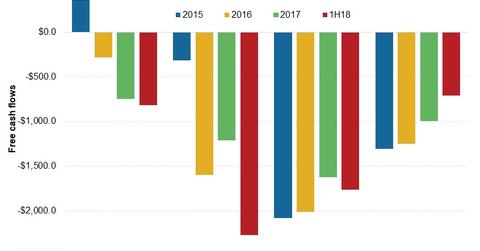

The top four utilities have failed to generate positive free cash flows in the last few years.

Nov. 20 2020, Updated 1:42 p.m. ET

Free cash flow

The top four utilities have failed to generate positive free cash flows in the last few years. Free cash flow (or FCF) is primarily used for dividend payments, so it’s more important for utility investors. In the first half of 2018, top utility NextEra Energy (NEE) reported free cash flow of -$817 million, while Dominion Energy (D) reported FCF of -$710 million.

FCF, the difference between operating cash flow and capital expenditure, is a vital metric in measuring utilities’ (XLU) performance. FCFs were squeezed in the last few years because utilities’ capital investment needs increased and cash from operations dwindled.

Duke Energy and Southern Company

Duke Energy (DUK) and Southern Company (SO), both leading regulated utilities, generated FCF of -$2.3 billion and -$1.8 billion, respectively, in the first half of 2018. Southern Company’s and Duke Energy’s FCFs have been negative for the last five years.

Southern Company stock was fairly weak recently. It has corrected more than 10% since it reported its second-quarter results last month. To learn more about that, read Southern Company Stock Trades Weakly on Vogtle Worries.