Analysts Raise Target Prices on UNH Stock in September

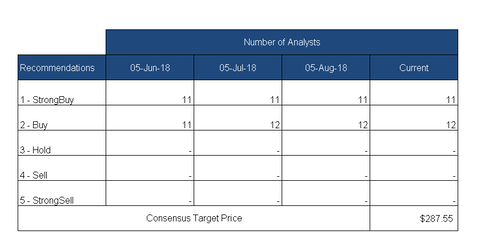

Of the 23 analysts covering UNH stock, all of them have “buy” or “strong buy” recommendations for UnitedHealth Group.

Sept. 6 2018, Updated 1:50 p.m. ET

Analysts’ views on UnitedHealth Group

As of September 5, according to a Reuters survey of 23 analysts covering UNH stock, all the analysts have “buy” or “strong buy” recommendations for UnitedHealth Group. Eleven of those analysts have a “strong buy” rating for the stock, and the remaining 12 have rated the stock a “buy.” None of the analysts gave it a “hold” or “sell” recommendation for UNH stock.

Target prices

According to the analysts, the consensus target price for UNH stock for the next 12 months is $284.50. That target price represents a return of ~6% for the next 12 months. It’s based on UNH’s closing price of $268.46.

Analysts’ average target prices for UNH peers Anthem (ANTM), Cigna (CI), and Aetna (AET) are $297.28, $223.06, and $203.27, respectively, implying 12.7%, 19.9%, and 1.2% returns over the next 12 months.

Recent ratings and target price updates

On September 5, Morgan Stanley raised its target price for UNH stock from $278 to $305. On September 4, Credit Suisse raised its target price from $270 to $304. In July, a number of investment research firms raised their recommendations and target prices after the company reported its Q2 2018 earnings results on July 17, although the stock fell that day.