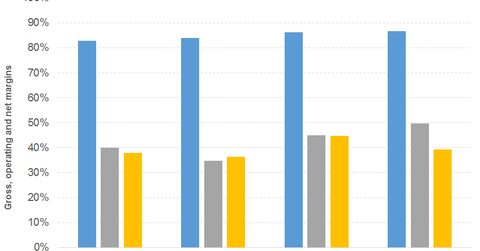

A Look at Facebook’s Profit Margin Growth since 2015

Apple’s (AAPL) operating expenses totaled $26.8 billion in 2017, and Amazon’s (AMZN) operating expenses totaled $61.8 billion in 2017.

Sept. 26 2018, Updated 12:00 p.m. ET

Factors that are driving Facebook’s gross margins

Facebook’s (FB) operating expenses rose 66.0% in 2015, followed by 29.0% and 31.0% increases in 2016 and 2017, respectively. Higher research and development expenses drove this growth.

Facebook’s operating expenses totaled $15.0 billion in 2017. These expenses increased at a three-year CAGR (compound annual growth rate) of 41.0% in 2017. Its operating expenses margin, which measures expenses in relation to revenues, declined from 43.0% in 2014 to 37.0% in 2017. This margin reached 49.0% in 2015 and fell to 41.0% in 2016.

A look at Facebook’s operating and net margins

Higher revenues, gross profit growth, and controlled expenses translated to income growth increases of 25.0%, 100.0%, and 63.0%, respectively, from Facebook’s operations for 2015, 2016, and 2017.

The company’s income from operations grew at a three-year CAGR of 59.0% to $20.2 billion in 2017. The company’s operating margin decreased from 40.0% in 2014 to 35.0% in 2015. However, the margin increased to 45.0% in 2016 and 50.0% in 2017.

Facebook’s interest and other non-operating income figures were insignificant compared to its revenue base. Its interest and other income totaled 1.0% of its revenues in 2017. The company’s net income growth increased from 38.0% in 2015 to 90.0% in 2016. Its net income grew 29.0% to $15.9 billion in 2017.

Facebook’s (FB) net margin declined from 38.0% in 2014 to 36.0% in 2015. However, this margin rose to 45.0% in 2016 before falling to 39.0% in 2017.

Earnings and operating expenses

Facebook’s EPS rose 29.0% and 86.0%, respectively, in 2015 and 2016. Its EPS rose by 46.0% to $6.20 in 2017. Its net income and EPS have grown at three-year CAGRs of 50.0% and 52.0%, respectively.

Apple’s (AAPL) operating expenses totaled $26.8 billion in 2017, and Amazon’s (AMZN) operating expenses totaled $61.8 billion in 2017. Netflix (NFLX) and Alphabet (GOOG) had operating expenses of $3.2 billion and $36.4 billion, respectively, in 2017.

Facebook’s high gross margins have translated into high operating and net margins. We’ll see how the other FAANG companies have performed with respect to their margins later in this series.