Why Genesee and Wyoming’s European Carloads Slumped in October

The decrease in the UK and European carloads in October was primarily due to the fall in coal and coke, mineral and stone, and intermodal carloads.

Nov. 20 2020, Updated 3:07 p.m. ET

Genesee and Wyoming’s European carloads

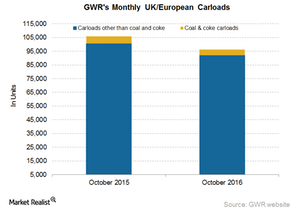

Genesee and Wyoming’s (GWR) the UK and European carloads fell 9% in October 2016. In the same period in 2015, GWR hauled 106,000 railcars compared with 96,000-plus in October 2016. After GWR’s Freightliner acquisition in March 2015, the former’s European operations assumed additional significance.

Commodities: Leaders and the laggards

The decrease in the UK and European carloads in October was primarily due to the fall in coal and coke, mineral and stone, and intermodal carloads. On the other hand, the volumes of metallic ores, lumber and forest products, and agricultural products were up in October 2016 on a year-over-year basis.

- Intermodal volumes fell 7.1% due to reduced shipments in continental Europe. This was a result of service cancellations and low utilization of services due to port congestion.

- Minerals and stone traffic fell 17.9%, mainly due to lower shipments in the UK and Poland

For Genesee and Wyoming, the term carload represents physical railcars and estimated railcar equivalents of commodities for which the company is paid. Genesee and Wyoming have been compared with Class I railroads since its operations span 75% of the US, parts of Canada, Australia, and some parts of Europe.

Other US-based Class I rail carriers include Norfolk Southern (NSC), CSX Corporation (CSX), Kansas City Southern (KSU), and Union Pacific (UNP).

The transportation and logistics sector forms part of the industrial sector. The ProShares Ultra S&P 500 ETF (SSO) invests ~6% in the industrial sector.

In this series, we examined the rail traffic data of major US railroads for the 44th week, which ended November 5, 2016.

For more information on major US railroad stocks (UNP), please visit Market Realist’s Railroads page.