How Spark Therapeutics Is Positioned in 2018

Spark Therapeutics generated revenues of $25.18 million in the second quarter of 2018 compared to $1.48 million in Q2 2017.

Dec. 4 2020, Updated 10:53 a.m. ET

Company overview

Spark Therapeutics (ONCE) is a gene therapy company focused on developing one-time treatments that are life-altering for genetic disease patients. The company’s Luxturna was approved in December 2017 for the treatment of retinal dystrophy. It’s the first FDA-approved gene therapy for a genetic disease and the first adeno-associated virus (or AAV) vector gene therapy approved in the United States.

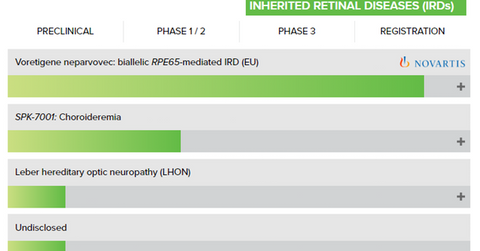

Spark Therapeutics has a licensing and commercialization agreement with Novartis (NVS) for its investigational voretigene neparvovec.

Spark Therapeutics has two gene therapy product candidates in its pipeline: SPK-7001 and SPK-8011. The former is targeted for the treatment of choroideremia (or CHM), an inherited retinal disease. The company has enrolled 15 patients in its Phase 1/2 trial. The drug has been well tolerated with no serious adverse events in the trial. SPK-7001 has been granted orphan product designation in the United States and the European Union.

Spark’s SPK-8011 is targeted for the treatment of hemophilia A. The drug is currently in a Phase 1/2 trial. Spark ‘s third product candidate, SPK-9001, which is targeted for the treatment of hemophilia B, was transitioned to Pfizer (PFE) for Phase 3 development under a license agreement in July. SPK-9001, now known as PF-06838435, has also received breakthrough therapy designation from the FDA.

Top line

Spark Therapeutics generated revenues of $25.18 million in the second quarter of 2018 compared to $1.48 million in Q2 2017. The increase was attributed to Luxturna sales and a surge in the company’s contract revenues. Its contract revenues increased from $1.48 million in the second quarter of 2017 to $20.87 million in the second quarter of 2018. Product sales were $4.31 million in the second quarter of 2018.

For fiscal 2018 and fiscal 2019, Spark Therapeutics is expected to generate revenues of $103.36 million and $122.62 million, respectively, compared to $12.07 million in fiscal 2017.

Next, let’s look at Spark Therapeutics’ valuation metrics.