What’s Driving Alcoa’s Stock?

Alcoa’s stock has witnessed a decent upwards move over the last few trading sessions, gaining more than 16% since November 12.

Nov. 26 2015, Updated 3:20 a.m. ET

Alcoa’s stock

Alcoa’s (AA) stock has witnessed a decent upwards move over the last few trading sessions, gaining more than 16% since November 12, when it hit its 52-week low of $7.81. Nonetheless, on a year-to-date basis it’s still down 40%. Together, Alcoa and ATI (ATI) form 8.5% of the SPDR S&P Metals and Mining ETF (XME).

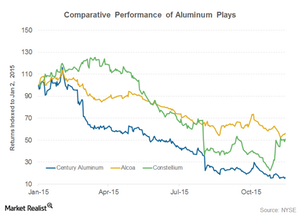

The graph above shows the recent stock market performance of aluminum companies. As you can see, Century Aluminum (CENX) and Constellium (CSTM) have also had a dismal run so far in 2015.

What’s been driving Alcoa?

Alcoa has been making news for the last couple of months. On September 28, Alcoa announced that the company would be splitting into two companies. The transaction is expected to be completed in the second half of 2016. Markets reacted well to the news and the stock closed at $9.59, up 5.7% from the previous day’s closing. Read Will Alcoa Splitting into 2 Companies Add Shareholder Value to learn more about the split.

On November 2, Alcoa announced massive production cuts of ~500,000 metric tons. Alcoa’s stock gained more than 2.5% after this announcement.

Now, Elliott Management has disclosed its stake in Alcoa. Alcoa’s stock soared more than 4.3% after the news. In its regulatory filing disclosing its stake in Alcoa, Elliott Management says that it finds Alcoa “dramatically undervalued by the public market.” Elliott also adds that Alcoa’s split would “create value substantially above the current share price.”

Series overview

In this series, we’ll explore the recent developments in Alcoa. We’ll look at the movement in aluminum prices and physical premiums. This should help you understand how Alcoa could play out in the coming months.