Insights into the Spain Services PMI for November 2017

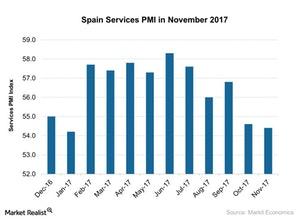

The final Spain Services PMI stood at 56.1 in November compared to 55.8 in October. It didn’t beat the preliminary market estimate of 56.5.

Dec. 13 2017, Published 9:12 a.m. ET

Spain’s Services PMI in November

According to a report by Markit Economics, the final Spain Services PMI (Purchasing Managers’ Index) stood at 56.1 in November compared to 55.8 in October. It didn’t beat the preliminary market estimate of 56.5.

The stronger performance in the Spain Services PMI for November was mostly due to the following:

- Production volume and output rose significantly in November compared to October.

- New business orders and export orders improved at a faster rate in November.

- Employment in the services sector rose at a faster pace in November.

ETF performances in November

The iShares MSCI Spain Capped ETF (EWP), which tracks Spain’s equity market performance, fell 0.6% in November 2017. The iShares MSCI Eurozone ETF (EZU), which tracks Europe’s (VGK) (IEV) (N100-INDEX) economic performance, fell 0.3% in November. Major ETFs remained flat that month, but services activity remained strong.

November expansion in factory activity is the strongest expansion since February 2007. Input cost inflation also rose in November. Stronger client demand and a shortage in raw materials mainly pushed up prices.

In the next part of this series, we’ll look at the Eurozone Services PMI for November 2017.