UPS: What Led Its Supply Chain and Freight Growth in Q3 2018?

United Parcel Service’s (UPS) Supply Chain & Freight vertical accounts for ~20% of its total revenues.

Oct. 30 2018, Updated 9:00 a.m. ET

UPS: Supply Chain and Freight’s revenues

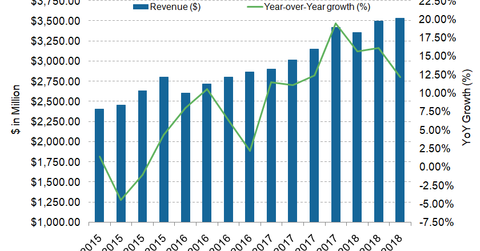

After reviewing United Parcel Service’s (UPS) International Package segment, we’ll take a close look at its Supply Chain and Freight segment’s performance. The logistics giant’s Supply Chain and Freight vertical accounts for ~20.0% of its total revenues.

In the third quarter, the division reported revenues of $3.5 billion, up 12.2% from $3.1 billion in the third quarter of 2017. Supply Chain and Freight’s revenue growth was due to strategies focused on small and medium-sized customers, which helped all the business units in the segment.

Supply Chain and Freight’s Q3 operating metrics

The main business units of United Parcel’s Supply Chain and Freight segment include Forwarding, Freight, Logistics, and Other. The Forwarding unit’s revenues comprise the largest share of the segment’s total revenues.

In the third quarter, the share of Forwarding revenues rose to 47.4% from 45.6% in the third quarter of 2017. Forwarding revenues grew 16.6% YoY (year-over-year) to $1.6 billion in the third quarter from $1.4 billion in the third quarter of 2017. The business unit’s revenue growth was due to pricing and tonnage gains.

The Freight unit’s revenue share reached 24.6% in the quarter, marginally down from 24.7% in the third quarter of 2017. Freight revenues jumped 11.4% YoY to $867.0 million in the third quarter from $778.0 million in the third quarter of 2017.

The rise in the Freight division’s revenues was due to higher pricing and heavier shipments. The share of Logistics revenues in the segment’s third-quarter revenues declined 1.0% to 22.4% in the quarter from 23.4% in the third quarter of 2017. The Logistics division’s revenues rose 7.3% to $790.0 million in the third quarter from $736.0 million in the third quarter of 2017.

Management’s outlook

United Parcel Service’s (UPS) business units in the Supply Chain and Freight segment benefit from market share gains, focused growth strategies, and revenue diversification. Its International Air Freight and truck brokerage businesses are expected to drive the segment’s revenue growth going forward.

Investors bullish on industrial stocks can consider the First Trust Industrials/Producer Durables AlphaDEX Fund (FXR). This ETF has 7.71% exposure to US railroads and 6.4% exposure to US trucking companies. FXR’s top transportation sector holdings include Knight-Swift Transportation (KNX) with 1.88% weight, Norfolk Southern (NSC) with 1.76% weight, and JetBlue Airways (JBLU) with 1.73% weight.

In the next section, we’ll look at UPS’s third-quarter operating margins.