How Gold Mining Industry Has Revived Itself

The last ten years have been a roller coaster ride for the gold (GLD) (GDXJ) (GDX) mining industry.

Feb. 3 2020, Updated 6:33 a.m. ET

VanEck

Reinvented Gold Industry Healthy and Competitive Again

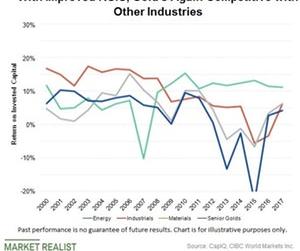

We frequently explain to investors how the gold mining industry has reinvented itself after years of mismanagement. The chart shows that the return on invested capital (ROIC) for senior gold companies fell below industry peers from 2012 to 2015. ROIC has since risen to historic norms and is again competitive. A number of factors have contributed to the gold industry’s turnaround.

Balance sheets are healthy again. CIBC World Markets finds net debt levels have fallen from $31 billion in 2014 to $17 billion in 2017, and we expect them to continue to fall. Mining costs have declined roughly 25% since 2012. Adoption of new technologies should allow costs to remain low. Free cash flow yields are expected to rise from 1.8% in 2018 to 8.1% in 2020, assuming a $1,300 per ounce gold price. Companies have recalibrated their portfolio of mines to focus on properties where they can create the most value. They have also become much better at hitting their targets. RBC Capital Markets found that in 2012, 60% of companies achieved production guidance and less than 50% delivered on original cost guidance. In 2017, production and cost guidance were achieved by 76% and 79% of companies, respectively.

Market Realist

Light shines on the gold mining industry

The last ten years have been a roller coaster ride for the gold (GLD) (GDXJ) (GDX) mining industry. However, recently, mining companies have adopted innovative techniques. In its 2018 “Tracking the Trends” report, Deloitte mentioned that mining players have committed to strengthening their balance sheets, implementing capital discipline, and reducing debt. These measures have helped the industry to generate better free cash flow, improve valuations, and offer better shareholder returns.

A few approaches adopted by the mining companies include Goldcorp’s (GG) multiyear strategy designed to move the company towards zero water use. The research paper also stated that mining companies are now going for conservative investments that could generate higher shareholder value rather than significant M&A transactions. Last year, Barrick Gold (ABX) and Goldcorp signed a 50-50 joint venture for the development of gold mines in the Maricunga belt in Chile.

Some Canadian miners are also gaining attention this year with tremendous stock gains year-to-date. Canada-based Wesdome Gold Mines is up 64%, Corvus Gold is up 55%, and Teranga Gold has gained 39% year-to-date.