Why J.M. Smucker Missed Q4 Earnings Estimate

J.M. Smucker (SJM) reported weaker-than-expected fiscal Q4 earnings.

Dec. 4 2020, Updated 10:53 a.m. ET

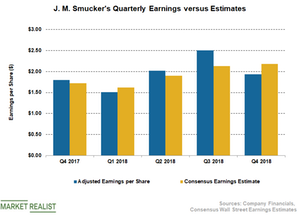

EPS versus estimate

J.M. Smucker (SJM) reported weaker-than-expected fiscal Q4 earnings for the period ended April 30, 2018. J.M. Smucker’s adjusted earnings of $1.93 per share increased 7.2% on a YoY (year-over-year) basis but fell well short of analysts’ estimate of $2.18. As the graph below shows, J.M. Smucker has exceeded analysts’ expectations in three of the past five quarters and has missed estimates in two of them.

J.M. Smucker’s fiscal Q4 earnings benefitted from a lower effective tax rate, which came in at 29.6% compared to 31.8% in the prior-year period. Also, lower input costs in the coffee segment, higher net price realizations, and a decline in the outstanding share count supported the company’s earnings growth rate.

However, lower volumes and the mix in the consumer foods segment, higher trade spending in the coffee segment amid increased competitive activity, and higher finance costs associated with the Ainsworth acquisition remained a drag. Also, product recall in the pet foods segment adversely impacted the company’s bottom line in the fiscal fourth quarter.

In comparison, lower taxes and cost savings have also been driving the bottom lines of the company’s peers. Both Conagra Brands (CAG) and Kellogg (K) reported stellar EPS growth in the last reported quarter. Meanwhile, General Mills (GIS) and Kraft Heinz’s (KHC) EPS growth also saw YoY improvements.

Outlook

J.M. Smucker’s management expects its fiscal 2019 EPS to be in the range of $8.40 to $8.65, representing YoY growth of 6% to 9%. Improvement in sales and cost savings are expected to drive the company’s bottom line. However, inflation in raw material and increased interest and logistics costs could restrict the EPS growth. Moreover, trade spending in the coffee segment further remains a drag.