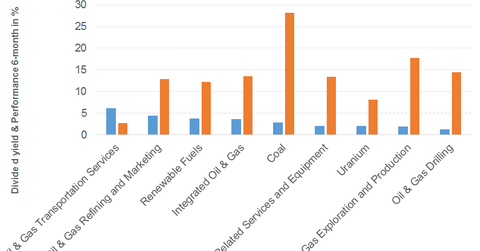

What’s the Energy Sector’s Dividend Yield?

Of all the energy segments, the oil and gas transportation services segment noted the highest dividend yield.

June 8 2018, Updated 3:01 p.m. ET

Energy industries

Of all the energy industries, the oil and gas transportation services segment noted the highest dividend yield. The rest of the industries barring uranium, oil-related services and equipment, oil and gas exploration, and production and oil and gas drilling underperformed the dividend yields of the broad-based stock indexes.

Industries under this sector and top dividend payers under the respective industries include:

- oil and gas transportation services with a dividend yield of 6.3% and Energy Transfer Equity (ETE)

- oil and gas refining and marketing with a dividend yield of 4.4% and China Petroleum & Chemical (SNP)

- renewable fuels with a dividend yield of 3.8% and FutureFuel (FF)

- integrated oil and gas with a dividend yield of 3.7% and Ecopetrol (EC)

- Coal with a dividend yield of 2.9% and Alliance Resource Partners (ARLP)

- uranium with a dividend yield of 2.3% and Cameco (CCJ)

- oil-related services and equipment with a dividend yield of 2.1% and Schlumberger (SLB)

- oil and gas exploration and production with a dividend yield of 2% and CNOOC (CEO)

- oil and gas drilling with a dividend yield of 1.2% and Helmerich & Payne (HP)

Renewable fuels, integrated oil and gas and oil and gas drilling industry prices ended in the red on June 1.

Going forward

The rapidly growing market presence for renewable and distributed energy triggered by technological advancement, falling costs, and growing preferences is a major boost for the sector. Further, rising cost efficiencies, unconventional oil drilling efficiencies, and growing demand for natural gas will likely continue to drive global imports and exports of oil and gas.

Dividend ETFs

The Schwab US Dividend Equity ETF (SCHD) offers a dividend yield of 2.6% at a PE of 20.3x. It has a 23% and 8% exposure to consumer non-cyclical and energy, respectively. The WisdomTree Emerging Markets Equity Income Fund (DEM) offers a dividend yield of 3.6% at a PE of 10.7x. It has 23% and 21% exposure to financials and energy, respectively.