How Will Berkshire Deploy Its Cash Pile of over $100 Billion?

Berkshire Hathaway (BRK.B) was sitting on liquidity of $118 billion at the end of the first quarter.

June 11 2018, Updated 11:55 a.m. ET

Continual acquisitions

Berkshire Hathaway (BRK.B) was sitting on liquidity of $118 billion at the end of the first quarter. The company is adding $3 billion to $4 billion in operating cash flows every month. On a YoY basis, its cash flows are expected to grow by 25% to 30% in 2018. At this rate, Berkshire could make big-ticket acquisitions on a continual basis.

Berkshire doesn’t reward shareholders with dividends. The company has a buyback policy in place subject to its valuation being lower than 1.2x of book or $20 billion and above in liquidity. Currently, Berkshire is trading at a price-to-book of 1.4x. Unless there is a major correction in broad markets and the stock, funds can’t be deployed in repurchases.

Other major asset managers and bankers (XLF) including BlackRock (BLK), Bank of America (BAC), and Blackstone (BX) are deploying liquidity faster than Berkshire. Asset managers have increased their assets at a faster pace by expanding product offerings across asset classes.

Expanding portfolio investments

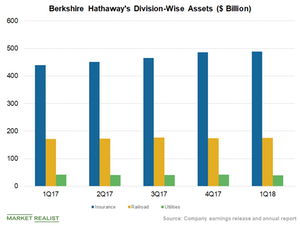

Berkshire Hathaway can also look at expanding its investment portfolio, which stands at $197 billion at the end of the first quarter. The company could look at expanding its portfolio by targeting investments in and outside of the US. Recently, Berkshire has built up a stake in Apple (AAPL) by purchasing stakes at regular intervals. It could target more stakes in banks, financial institutions, and technology firms with reasonable valuations.

During the 2007 financial crisis, Buffett had lower liquidity. Since then, Berkshire has continually increased liquidity partly due to higher cash flows and lack of acquisition opportunities amid rising valuations. The company’s current position means its well poised to tackle any major hit or recession in the near future.