Why Campbell Soup’s Fiscal 3Q18 Sales Could Mark Strong Growth

Campbell Soup’s sales in the Americas Simple Meals and Beverages segment is projected to decline in fiscal 3Q18.

Dec. 4 2020, Updated 10:42 a.m. ET

Analysts project double-digit growth

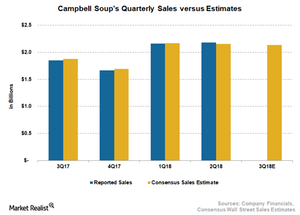

Analysts expect Campbell Soup (CPB) to report sales of $2.1 billion in fiscal 3Q18,[1. fiscal 3Q18 ended March 31] which represents YoY (year-over-year) growth of 15.0%. Incremental sales from its Pacific Foods acquisition and favorable currency rates are expected to drive its top line higher. New products could support its sales growth rate in fiscal 3Q18.

However, the decline in its US soup sales is expected to hurt the company’s top-line growth rate. Sales of V8 beverages are expected to decline amid a consumer shift toward health and wellness drinks. Challenges in its Super-Premium Juice segment could pressure its growth.

The top-line numbers for Campbell Soup’s peers have benefited from incremental sales from their acquired brands. Kellogg’s (K), Hershey’s (HSY), and Conagra Brands’ (CAG) sales showed sequential improvement, thanks to higher sales from their acquired brands. New product launches further supported their volumes.

Sales by segments

Campbell Soup’s sales in the Americas Simple Meals and Beverages segment is projected to decline in fiscal 3Q18. Benefits from its Pacific Foods acquisition and new product launches are expected to be more than offset by continued weakness in sales of its soups and V8 beverages. Sales for V8 beverages could slide amid the consumer shift toward healthy drinks, while the rate of decline in its US Soup segment’s sales is expected to decelerate.

Sales in the C-Fresh segment could show some improvement, led by new products and higher carrot sales. Plus, supply constraint issues are likely to dissipate. However, challenges in its Super-Premium Juice segment are expected to subdue its growth.

Campbell Soup’s sales in its Global Biscuits and Snacks segment are expected to grow, driven by strength in Pepperidge Farm and Kelsen.