What’s Wall Street’s Forecast for Nabors Industries?

Approximately 66% of the Wall Street analysts tracking Nabors Industries rated it as a “buy” or some equivalent.

Nov. 20 2020, Updated 2:09 p.m. ET

Wall Street’s forecast for Nabors Industries

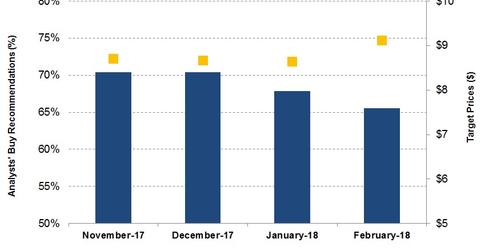

In this article, we’ll look at Wall Street analysts’ forecasts for Nabors Industries’ (NBR) shares on February 12, 2018. Approximately 66% of the Wall Street analysts tracking Nabors Industries rated it as a “buy” or some equivalent.

Approximately 34% rated the company as a “hold.” None of the sell-side analysts recommended a “sell” or an equivalent for NBR.

Nabors Industries comprises 0.15% of the iShares US Energy ETF (IYE). IYE decreased 10.0% in the past year compared to a 58.6% decline in NBR’s stock price during the same period.

In comparison, ~72% of the sell-side analysts tracking Patterson-UTI Energy (PTEN) rated it as a “buy” or some equivalent on February 12, 2018. Approximately 24% of the sell-side analysts rated the company a “hold.”

Analysts’ rating changes for NBR

From November 12, 2017, to February 12, 2018, the percentage of analysts recommending a “buy” or some equivalent for NBR has decreased from 70% to 66%. The sell-side analysts’ “hold” recommendations have increased for NBR during this period. A year ago, ~73% of the sell-side analysts recommended a “buy” for NBR.

Analysts’ target prices for NBR

Wall Street analysts’ mean target price for NBR on February 12 was $9.12. NBR is currently trading at $6.61, implying an ~38.0% upside at its current price. Analysts’ average target price for NBR was $8.64 a month ago.

Target prices for NBR’s peers

The mean target price surveyed among the sell-side analysts for Helmerich & Payne (HP) was $64.50 on February 12. HP is currently trading at ~$64.63, implying nearly zero returns at its current price.

The mean target price surveyed among the sell-side analysts for Flotek Industries (FTK) was $7.00 on February 12. FTK is currently trading at ~$5.00, implying a 40% upside at its current price.

For more information on this industry, please read Market Realist’s How Schlumberger and Halliburton Stack Up after 4Q17 Results. You can also refer to Schlumberger and Halliburton: A Comparison after 4Q17.