What Drove Revenue for Cisco’s Infrastructure Platform in Q3?

Cisco’s (CSCO) Infrastructure Platform segment is the company’s largest business segment in terms of revenue.

May 16 2019, Published 12:19 p.m. ET

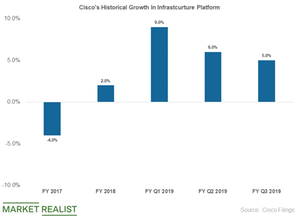

Infrastructure platform revenue rose 5% in Q3 2019

Cisco’s (CSCO) Infrastructure Platform segment is the company’s largest business segment in terms of revenue. The Infrastructure segment accounted for 58% of total sales in the third quarter of 2019. Sales rose 5% YoY in the third quarter to $7.54 billion.

Cisco has been looking to integrate intent-based networking across its enterprise access portfolio to help enterprises easily manage users and devices connected to their networks. Cisco is a market leader in network infrastructure and continues to lead innovation across enterprise routing and SD-WAN (software defined wireless area network) verticals.

As enterprises move towards wireless connectivity, the demand for wireless networks continues to rise. Enterprises now must be equipped and optimized for security and need to leverage machine learning capabilities to gain insights from data and security integration.

Cisco’s product portfolio is robust

Cisco announced several platforms in the third quarter and continues to expand its networking portfolio with the launch of Wi-Fi 6. Cisco recently adopted Wi-Fi 6, which it claims to be the new standard for Wi-Fi networks.

Cisco has refreshed its enterprise networking portfolio with the addition of Catalyst 9000. It now has a single operating system and policy management platform to help achieve consistency and simplicity across enterprise networks.

Cisco has partnered with Amazon Web Services (AMZN), Google Cloud (GOOGL), and Microsoft Azure (MSFT) in the data center space. Cisco introduced cloud ACI (application centric infrastructure) for Amazon Web Services, which allows customers to manage and secure applications running on Amazon’s cloud environment.

Cisco expanded its partnership with Google and announced support for the latter’s multi-cloud platform to help customers build secure applications easily. Cisco is a powerhouse in network infrastructure. It will likely continue to lead the network infrastructure space going forward as well driven by its partnerships, expertise, and portfolio of products.