How Is JNJ Maintaining Its Momentum in Interventional Solutions?

JNJ’s interventional solutions business registered a year-over-year rise of 16.6% in the first quarter of 2018.

May 31 2018, Updated 10:32 a.m. ET

JNJ’s interventional solutions business

Johnson & Johnson’s Medical Devices business provides therapies and solutions across five areas: interventional solutions, diabetes care, orthopedics, surgery, and vision care. The company’s interventional solutions business’s sales of $640 million contributed ~9.5% to its total Medical Devices segment’s sales of $6.8 billion in the first quarter of 2018.

JNJ reported total sales of $20 billion in the first quarter. The interventional solutions business registered a year-over-year rise of 16.6% in the quarter.

As of the first quarter, the interventional solutions business includes the company’s neurovascular and cardiovascular platforms. It includes the Cerenovus neurovascular business and the Biosense Webster business, which is focused on electrophysiology. The company created Cerenovus in September 2017 after its divestiture of Codman Neuro and its acquisitions of Neuravi and Pulsar Vascular. Previously, Codman’s neurosurgery and Cerenovus sales were reported under the company’s orthopedics business.

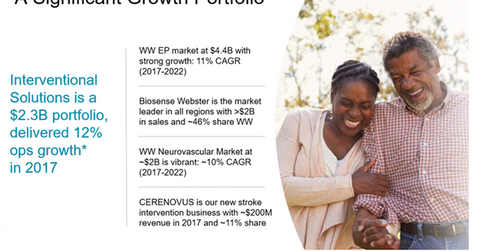

Interventional solutions market position and opportunity

In the first quarter, JNJ reported significant growth in the atrial fibrillation procedure market, which drove the company’s electrophysiology sales by ~15%. The company is launching new products in its interventional solutions business to strengthen its market position in this space.

The interventional solutions business’s market size was $6 billion in 2017, and it’s expected to grow at a CAGR (compound annual growth rate) of ~11% from 2017 to 2022.

The electrophysiology market is estimated to be $4.4 billion with a CAGR of ~11% from 2017 to 2022. JNJ’s electrophysiology business unit, Biosense Webster, has a share of over 45% in the market and has delivered strong double-digit growth over the last nine years. The global neurovascular market is estimated to be worth $2 billion and to be growing at a CAGR of 10%. JNJ is the fourth-largest player in this market.

In the next article, we’ll discuss JNJ’s market position and growth strategy for its atrial fibrillation portfolio.