How Miners’ Correlations Are Moving

Precious metals prices have risen from the ten-month lows they saw in December 2016. As a result, most mining stocks have also risen substantially.

Feb. 17 2017, Updated 11:35 a.m. ET

Mining stocks and gold

It’s important to understand which mining stocks have overperformed and which have underperformed precious metals. Precious metals prices have risen from the ten-month lows they saw in December 2016. As a result, most mining stocks have also risen substantially. It’s important to study how mining companies correlate with gold.

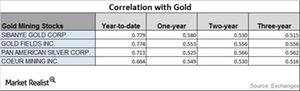

Mining companies with high correlations with gold include Sibanye Gold (SBGL), Gold Fields (GFI), Pan American Silver (PAAS), and Coeur Mining (CDE). These companies rose significantly YTD (year-to-date) in 2016, and 2017 started with a price revival.

Correlation trends

As you can see in the above table, Sibanye Gold has the closest correlation to gold on a YTD basis among the four miners under review. Coeur Mining is the least correlated with gold, mainly due to its YTD losses.

Coeur Mining, which has the lowest YTD correlation with gold, and Sibanye Gold have seen their correlations with gold rise in the last three years. Sibanye Gold’s correlation rose from a ~0.51 three-year correlation to a ~0.78 YTD correlation. A correlation of ~0.78 suggests that about 78% of the time, Sibanye Gold has moved in the same direction as gold in the last year. Usually, a fall in gold leads to falling mining stock prices, and vice versa.

The relationships between gold and Gold Fields and Pan American Silver haven’t been stable and have seen upward-downward trends. The mining funds that have visible correlations with precious metals fluctuations include the Proshares Ultra Silver ETF (AGQ) and the VanEck Vectors Gold Miners ETF (GDX).