Are Oil’s Supply Concerns Rising?

On May 21, US crude oil July futures closed $5.97 above the July 2019 futures contract. On May 14–21, US crude oil July futures rose 1.9%.

Dec. 4 2020, Updated 10:53 a.m. ET

Futures spread

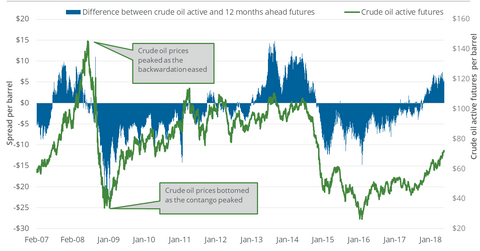

On May 21, US crude oil July futures closed $5.97 above the July 2019 futures contract. On May 14, the futures spread or the price difference was at a premium of $5.75. On May 14–21, US crude oil July futures rose 1.9%.

The market sentiment towards oil’s demand and supply situation is reflected in the futures spread. In the past five trading sessions, the spread expanded and US crude oil prices rose almost 2%. US sanctions on Iran and possible new sanctions on Venezuela discussed in Part 1 kept the market concerned about oil’s supply.

Energy stocks

On May 14–21, Denbury Resources (DNR), Whiting Petroleum (WLL), and Diamondback Energy (FANG) rose 18.2%, 11.3%, and 10.2%, respectively—the largest gainers on our list of oil-weighted stocks.

Forward curve

As of May 21, US crude oil futures contracts for delivery between July 2018 and June 2019 were priced in descending order. The price pattern will likely be positive for ETFs that follow US crude oil futures like the ProShares Ultra Bloomberg Crude Oil ETF (UCO) and the United States 12 Month Oil ETF (USL).