Ralph Lauren: Stock Returns and Valuations

Though Ralph Lauren (RL) has been having a tough time attracting customers, it has been able to impress investors with its stock market gains.

Jan. 25 2018, Updated 10:34 a.m. ET

Stock market performance

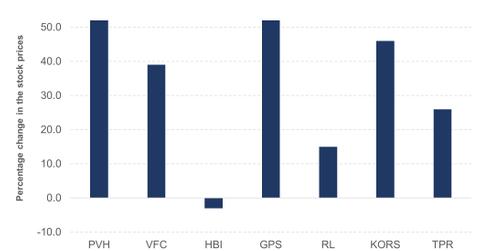

Though Ralph Lauren (RL) has been having a tough time attracting customers, it has been able to impress investors with its stock market gains. RL surged ~15% in 2017 and has gained about 8.8% so far this year as of January 22.

Competitors PVH (PVH), VF (VFC), Michael Kors (KORS), and Tapestry (TPR) also had a great 2017. The companies gained 52%, 39%, 46%, and 26%, respectively, during the year. The S&P 500 Apparel and Accessories index soared 20% during the year while the S&P 500 Index was up 19%.

Dividends

Ralph Lauren has been a consistent dividend payer. The company recently announced a dividend of 50 cents, which was payable on January 12.

It has a one-year forward dividend yield of 2%. In comparison, dividend-paying companies VFC, Hanesbrands (HBI), and Tapestry have higher dividend yields of 2.4%, 2.8%, and 3%, respectively.

Valuations and earnings potential

Ralph Lauren is currently trading at a one-year forward price-to-earnings ratio of 18.9x versus its three-year average of 17x. The company trades at a premium to Michael Kors (16.3x), Hanesbrands (11.1x), and PVH (16.6x) and a discount to VFC (23x).

However, it has a weaker near-term earnings potential than most of the companies mentioned above. Its earnings per share (or EPS) are likely to fall 3.6% over the next 12 months (or NTM). In comparison, PVH, VFC, and HBI are likely to report a 13.4%, 9.3%, and 1.1% respective increase in NTM EPS. Michael Kors, which is also undergoing strategic remodeling projects, is expected to report a 12.4% fall in EPS.

ETF investors interested in getting exposure to Ralph Lauren can consider the Guggenheim S&P 500 Equal Weight Consumer Discretionary ETF (RCD), which invests 1.42% of its portfolio in the company.

See the next part of this series to learn about Wall Street’s take on RL.