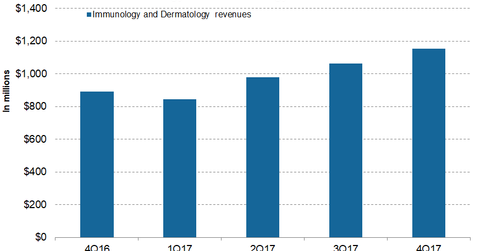

A Look at Novartis’s Immunology and Dermatology Segment’s Performance

In 4Q17, Novartis’s Immunology and Dermatology segment generated revenues of $1.2 billion, ~30% growth on a year-over-year (or YoY) basis and ~9% growth quarter-over-quarter.

March 30 2018, Updated 7:32 a.m. ET

Immunology and Dermatology segment revenue trends

In 4Q17, Novartis’s Immunology and Dermatology segment generated revenues of $1.2 billion, ~30% growth on a year-over-year (or YoY) basis and ~9% growth quarter-over-quarter. In fiscal 2017, Novartis’s (NVS) Immunology and Dermatology business generated revenues of $4.0 billion compared to $3.0 billion in 2016, which reflected ~34% YoY growth.

Neoral/Sandimmune revenue trends

In 4Q17, Novartis’s Neoral reported revenues of $124 million, which reflected a ~2% decline on a YoY basis and a 2% decline quarter-over-quarter. In 2017, Neoral reported revenues of $488 million compared to $515 million in 2016, which is a ~5% decline on a YoY basis.

Competition from the generic versions of the drug primarily led to the slight decline of revenues. Neoral is used as an immunosuppressant to prevent organ rejection after liver, kidney, heart, lung, and bone marrow transplants. Astellas Pharma’s (ALPMY) Prograf is one of Neoral/Sandimmune’s competitors.

Zortress/Certican revenue trends

In 4Q17, Novartis’s Zortress/Certican reported revenues of $116 million, which reflected ~12% YoY growth and ~8% quarter-over-quarter growth. In 2017, Zortress/Certican generated revenues of $414 million compared to $398 million in 2016, which reflected ~4% growth on a YoY basis. Zortress is also used to prevent organ rejection during adult heart and kidney transplant surgeries.

Myfortic revenue trends

In 4Q17, Myfortic generated revenues of $104 million, which reflected ~14% growth on a YoY basis and 11% growth quarter-over-quarter. In 2017, Myfortic generated revenues of $378 million compared to $383 million in 2016, which reflected a ~1% decline on a YoY basis.

Myfortic witnessed high growth despite the loss of market exclusivity in several markets. In the marketplace, Zortress and Myfortic’s peer drugs include Pfizer’s (PFE) Rapamune and Roche’s (RHHBY) CellCept.

Illaris revenue trends

In 4Q17, Ilaris generated revenues of $115 million compared to $75 million in 4Q16, which reflected ~53% growth on a YoY basis and ~7% growth quarter-over-quarter. In fiscal 2017, Illaris generated revenues of $402 million compared to $283 million in 2016, which is ~42% YoY growth.

Illaris witnessed growth across all major regions. Illaris is used for the treatment of various inflammatory conditions including cryopyrin-associated periodic syndrome (or CAPS) and systemic juvenile idiopathic arthritis.