Why the Walt Disney Company Reorganized

In 2017, Disney agreed to acquire the bulk of Fox assets for $52.4 billion, or $66.1 billion including debt.

Nov. 20 2020, Updated 3:53 p.m. ET

Direct-to-consumer unit created

The Walt Disney Company (DIS) recently announced a sweeping reorganization of its business structure, creating a new business unit and expanding another. The company created a new unit, Direct-to-Consumer and International, which is expected to oversee direct-to-consumer streaming platforms.

In 2017, Disney stated that it would pull its movies from Netflix (NFLX) as it prepares to launch its direct-to-consumer video services. These new services are expected to take on Netflix, Amazon (AMZN), and other industry competitors. Kevin Mayer, who recently served in the role of chief strategy officer, is slated to helm Disney’s newly created Direct-to-Consumer unit.

Parks and Resorts division expanded

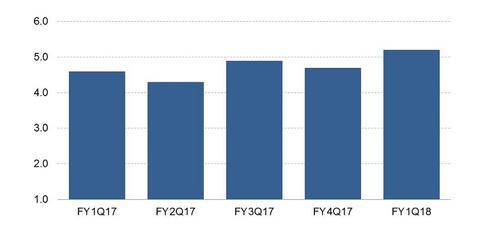

The reorganization also saw Disney expand its Parks and Resorts arm to include consumer products and interactive media, such as video games and books. Disney’s Parks and Resorts business generated $5.2 billion in revenues in fiscal 1Q18 (calendar 4Q17). These revenues represented growth of 13.0% year-over-year and contributed 33.8% to the company’s overall revenues.

Responding to industry shifts

Disney’s reorganization is a response to the rapidly changing media landscape and is designed to better position it going forward. Its future seems to include integrating and operating the portfolio of businesses Disney is acquiring from 21st Century Fox (FOX).

In 2017, Disney agreed to acquire the bulk of Fox assets for $52.4 billion, or $66.1 billion including debt. Verizon (VZ), Sony (SNE), and Comcast (CMCSA) also showed interest in acquiring the assets. However, they were rebuffed because Fox felt a deal with Disney would win regulatory approval without delay or much opposition. Comcast is now challenging Fox for the acquisition of Sky, a European broadcaster that owns lucrative sports rights in Europe.