Why Did Wendy’s Revenue Fall in 1Q16?

Wendy’s Company (WEN) generates its revenue through company-owned restaurant sales, franchisee fees, rental income, and royalty collected from franchisees.

May 13 2016, Published 2:36 p.m. ET

Revenue sources

Wendy’s Company (WEN) generates its revenue through company-owned restaurant sales, franchisee fees, rental income, and royalty collected from franchisees.

1Q16 performance

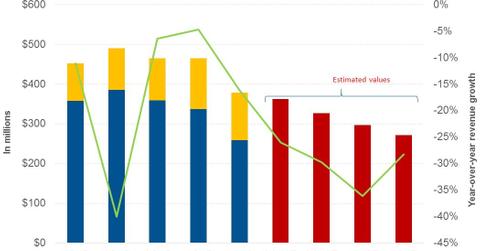

Wendy’s posted revenue of $378.8 million, a fall of 16.2% from $452 million in 1Q15. Due to its optimization strategy, the company is selling its company-owned restaurants to franchisees.

Compared to 1Q15, Wendy’s operated 361 fewer company-owned restaurants, which led to a 27.5% fall in revenue from this segment, from $357.6 million to $259.3 million.

The company’s revenue from its franchised restaurants rose 26.5%, from $94.4 million to $119.5 million. The rise in revenue in this segment was primarily driven by a rise in rental revenue from its franchisees. Also, the number of franchised Wendy’s restaurants rose by 355, and positive same-store sales growth led to growth in franchisee fees and royalties collected from these franchisees.

Peer comparison

In 1Q16, Wendy’s peers McDonald’s (MCD), Jack in the Box (JACK), and Restaurant Brands International (QSR) posted revenue growth of -0.9%, 0.8%, and -1.6%, respectively.

Outlook

Analysts expect Wendy’s, which forms 0.15% of the holdings of the iShares Core S&P Mid-Cap ETF (IJH), to post revenue of $1.4 billion in 2016. This revenue estimate for 2016 represents a potential fall of 37.1% from $1.9 billion in 2015.

The fall in expected revenue may be due to Wendy’s optimization strategy, wherein the company is refranchising to lower its percentage of company-owned restaurants to 5% by the end of 2016.