How Prologis Boosted Top-Line Growth in 2Q17

Prologis’s (PLD) upbeat top-line and bottom-line results in 2Q17 were driven by higher-than-expected rent growth and net operating income.

Nov. 20 2020, Updated 4:42 p.m. ET

Robust 2Q17

Prologis’s (PLD) upbeat top-line and bottom-line results in 2Q17 were driven by higher-than-expected rent growth and net operating income.

Prologis ensures its profitability through strategic capital deployment in order to maintain leadership in the industry. The company has completed several acquisitions and dispositions of its properties to improve the efficiency of its operations as well as scale.

Acquisition to bolster presence in Brazil

During 2Q17, Prologis inked a deal to take over 100% interest in its Brazilian subsidiary, Prologis CCP, for approximately $362 million. The deal, which is expected to close later this year, will bolster the company’s presence in the country.

Further, Prologis has gone ahead with plans to rationalize its ownership in NAIF (North American Industrial Fund). It has shifted $2.8 billion of its assets from NAIF to its Prologis Targeted U.S. Logistics Fund (USLF). In the first quarter 2017, the company acquired 100% of NAIF. Plus, it announced its plans to rationalize the property over the next few years.

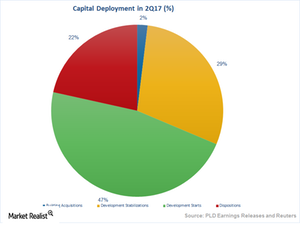

During 2Q17, Prologis undertook building acquisitions worth $37 million. It also carried out development stabilizations worth $560 million. The worth of development starts stood at $897 million. Prologis made dispositions and contributions worth $410 million during the period.

Prologis has increased its owned and managed real estate by 85 million square feet, or approximately 16%, over the last two years. The company continues to embark on such activities in order to streamline its operation and achieve economies of scale.

The above-mentioned strategic steps are in sync with the company’s policy to expand its funds into more profitable channels.

Further, during 2Q17, Prologis completed 20 build-to-suit development projects worth $430 million. The company’s strategic logistics warehouses situated in advantageous regions help the company maintain business momentum.

Peers Duke Realty (DRE), Boston Properties (BXP), and Kilroy Realty (KRC) in the REIT sector are resorting to acquisition and rationalization of their portfolio to maintain profit. Prologis, Duke Realty, Kilroy, and Boston Properties form 14.1% of the iShares Cohen & Steers REIT ETF (ICF).