The Outlook for US Steel Prices in 4Q17

Steel prices Along with steel production, steel prices are among the most important drivers of US steelmakers’ earnings. Therefore, steel and iron ore investors should track US steel prices (SLX). After being depressed for a long period, US steel prices started their upward march in 2016 after high anti-dumping duties were levied on imported steel. Prices also […]

Oct. 10 2017, Updated 10:38 a.m. ET

Steel prices

Along with steel production, steel prices are among the most important drivers of US steelmakers’ earnings. Therefore, steel and iron ore investors should track US steel prices (SLX).

After being depressed for a long period, US steel prices started their upward march in 2016 after high anti-dumping duties were levied on imported steel. Prices also got support from Trump’s election in November 2016. His stance on protectionism and infrastructure spending reassured steel investors.

Steel price progression

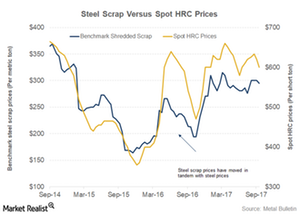

YTD (year-to-date), prices have been range bound. While prices rose to a high of $660 per ton in March, they fell to $580 per ton in June. HRC (hot rolled coil) prices moved sideways in August and September 2017, ranging between $610 and $630 per ton.

Outlook

Analysts’ outlook on 4Q17 US steel prices differs. BMO Capital Markets analysts believe that US steel prices should see positive momentum going forward, mainly due to higher input costs. Bank of America Merrill Lynch also expects steel to reach $700 per ton in 4Q17. Cowen and Company, on the other hand, believes that steel and iron ore prices are poised to move lower.

The downside to US steel prices may be limited, given the moderate spreads between US and international steel prices. Steel prices affect companies such as AK Steel (AKS), U.S. Steel Corporation (X), Nucor (NUE), and Cleveland-Cliffs (CLF).