How Wall Street Analysts Rate LyondellBasell ahead of 1Q18 Earnings

The analyst consensus target price for LyondellBasell is $116.82, implying a return potential of 8.5% over the closing price of $107.68 as of April 20, 2018.

Dec. 4 2020, Updated 10:52 a.m. ET

Analyst consensus on LyondellBasell

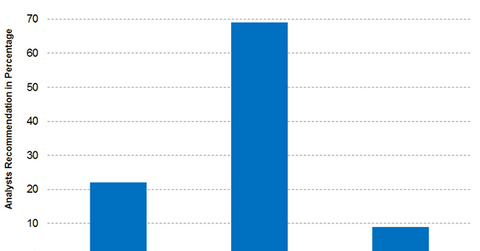

The number of analysts tracking LyondellBasell (LYB) since its previous earnings has come down from 24 to 23. 22% of these analysts have given “buy” recommendations, 69% have insisted on a “hold,” while 9% have recommended a “sell.”

The analyst consensus target price for LyondellBasell is $116.82, implying a return potential of 8.5% over the closing price of $107.68 as of April 20, 2018. LYB has more or less hovered around the current target price.

LYB’s move towards the acquisition of A. Schulman (SHLM) and antitrust clearance for the acquisition could signify future growth for LYB. LYB has also initiated a joint venture with SUEZ and acquired Quality Circular Polymers. The increase in the crude oil prices could help its refinery segment growth in a significant manner. As a result, many analysts have recommended the stock as a “hold.” LYB’s 1Q18 earnings could give a clear direction on the stock.

Individual analyst recommendations

- BMO has rated LyondellBasell as “outperform” with a target price of $111, implying a potential return of 3.1% over its closing price of $107.68 as of April 20, 2018.

- Morgan Stanley (MS) has recommended LYB as a “buy” with a target price of $130, implying a return potential of 20.7% over its closing price as of April 20, 2018.

- Barclays (BCS) has rated LyondellBasell as “overweight” and recommended a target price of $125, which implies a potential return of 16.1% over its closing price as of April 20, 2018.

Investors can invest in the iShares Edge MSCI Multifactor Materials ETF (MATF) to hold LYB indirectly. MATF has invested 6.9% of its portfolio in LYB as of April 20, 2018.