Honeywell’s Performance Materials and Technologies: Why It Fell

Honeywell’s (HON) Performance Materials and Technologies (or PMT) segment accounted for 22.2% of HON’s total revenue in 2Q17.

Nov. 20 2020, Updated 3:41 p.m. ET

Honeywell’s Performance Materials and Technologies segment in 2Q17

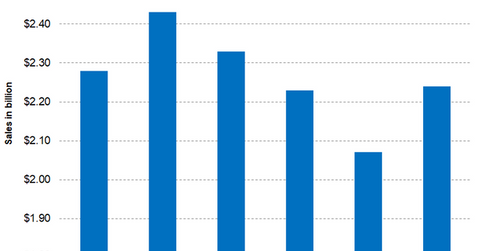

Honeywell International’s (HON) Performance Materials and Technologies (PMT) segment is the third-largest revenue contributor to the company’s overall revenue. The segment accounted for 22.2% of HON’s total revenue in 2Q17, compared to 24.4% in 2Q16. The segment reported revenue of $2.2 billion in 2Q17, a 7.8% fall on a year-over-year basis. In 2Q16, the segment reported revenue of $2.4 billion.

The fall in the segment’s revenue was primarily driven by the spin-off of the resins and chemicals business, which is now listed as AdvanSix (ASIX). Honeywell’s UOP business witnessed good growth due to new business deals. Solstice, its low-global-warming product lineup, witnessed double-digit growth. But Honeywell Process Solutions fell due to lower volumes.

Net income and margin

The PMT segment’s net income for 2Q17 was reported at $524.0 million, a marginal rise of 0.80% on a year-over-year basis. In 2Q16, the segment’s net income was $520.0 million. The increase in net income was primarily driven by productivity and the segment’s lower cost of goods sold (or COGS). PMT’s COGS stood at $1.4 billion in 2Q17, representing 63.4% of sales. In 2Q16, COGS stood at 66.3%, a gain of 285 basis points on a year-over-year basis. As a result, the segment’s margin improved with a net income margin of 23.4% during the quarter. In 2Q16, the margin was 21.4%.

Segment outlook

The spin-off of the resin and chemicals business will continue to adversely impact the PMT segment’s revenue. Growth for Solstice is expected to continue, and a backlog growth could contribute to increasing revenue. Productivity gains will help the segment post higher income.

If you’re looking for exposure to Honeywell, you can invest in the iShares Global Industrials (EXI), which has invested 2.4% of its portfolio in HON. The top holdings of the fund include General Electric (GE), 3M (MMM), and Boeing (BA) with weights of 5.2%, 2.9%, and 2.8%, respectively, as of July 21, 2017.