GlaxoSmithKline’s Pharmaceuticals Segment in 1Q17

The Pharmaceuticals segment reported an operational growth of 4.0% and a 13.0% positive impact of foreign exchange, resulting in a rise of 17.0% in revenues.

June 1 2017, Updated 7:38 a.m. ET

Pharmaceuticals segment

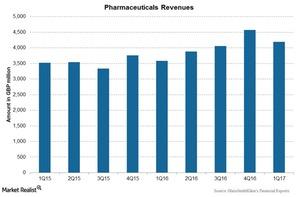

GlaxoSmithKline’s (GSK) Pharmaceuticals segment includes various products classified as HIV (human immunodeficiency virus) products, respiratory products, immuno-inflammation products, and established products. The segment reported an operational growth of 4.0% and a 13.0% positive impact of foreign exchange, resulting in a rise of 17.0% in reported revenues to ~4.2 billion pounds in 1Q17. The rise in revenues was mainly due to the strong performance of Triumeq, Tivicay, Nucala, and Relvar Ellipta/Breo Ellipta.

The above graph shows revenues for the Pharmaceuticals segment over the past nine quarters. The segment contributed ~57.0% of total revenues for 1Q17.

Global pharmaceuticals

Global pharmaceuticals include products from various franchises, including respiratory products, immuno-inflammation products, and established products. Global pharmaceuticals revenues were ~3.2 billion pounds in 1Q17, which included a 5.0% operational growth in revenues to ~1.7 billion pounds from respiratory products, 23.0% operational growth to 92.0 million pounds from immuno-inflammation products, and a 6.0% operational fall in revenues to ~1.4 billion pounds from established pharmaceuticals.

HIV products

HIV products are marketed under ViiV Healthcare, a company in which GSK is a major shareholder. Pfizer (PFE) and Shionogi are also shareholders in the company. HIV products include Tivicay, Triumeq, and other products, contributing ~23.0% of the total pharmaceutical salesxoSmithKline. The HIV products portfolio reported an operational growth of 19.0% to ~985.0 million pounds in 1Q17.

To divest the risk, you can consider ETFs such as the Schwab International Equity ETF (SCHF), which holds 0.70% of its total assets in GlaxoSmithKline. SCHF also holds 0.70% of its total assets in Sanofi (SNY), 0.60% in AstraZeneca (AZN), and 0.60% in Novo Nordisk (NVO).