Costco, Walmart, and Target: Comparing Earnings Growth

Costco (COST) continues to impress with its high earnings growth rate despite its continued focus on prices amid increased competition from Amazon (AMZN).

April 2 2018, Published 11:55 a.m. ET

Costco outperforms Walmart and Target

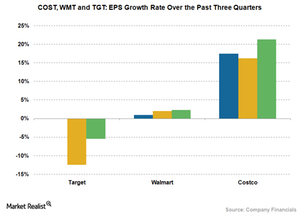

Costco (COST) continues to impress with its high earnings growth rate despite its continued focus on prices amid increased competition from Amazon (AMZN). Costco has been able to generate a double-digit EPS (earnings per share) growth rate over the past four quarters and has outperformed both Walmart (WMT) and Target (TGT).

The graph below shows that Costco has been outperforming Walmart and Target with its earnings growth rate. Over the past three quarters, Walmart’s bottom line results improved, but the rate of growth remained significantly lower than Costco’s. Target Corporation’s EPS continued to decline on a YoY (year-over-year) basis, reflecting increased investments in growth initiatives.

Mass merchandisers continue to focus on prices in order to drive store traffic as competition heats up with Amazon’s expansion into the grocery space. Moreover, increased digital fulfillment charges (mainly for Target and Walmart) and an adverse mix due to the growing share of e-commerce sales continue to dent margins and, in turn, EPS growth rates.

Costco’s impressive sales growth rate, higher membership fee income, and tight control on overhead costs continue to drive its bottom line higher.

Outlook

Analysts expect Costco to report strong double-digit earnings growth in the coming quarters, driven by its sales leverage and cost savings. Target’s management expects its EPS to stabilize and return to growth in 2018. Walmart’s EPS are also projected to improve on a YoY basis.

However, price investments, digital fulfillment costs, and investments in growth initiatives are likely to affect the bottom lines for these companies.