A Look at Vornado’s Top-Line Performance

Vornado Realty Trust (VNO) is in talks to finalize the tax-free spinoff of its business in Washington, D.C. VNO expects to concentrate solely on its New York business after the spinoff.

July 6 2017, Updated 9:09 a.m. ET

Will commercial REITs be able to maintain their top-line growth?

It’s common knowledge that commercial REITs are currently in the doldrums. Malls in the US are suffering as they struggle with dwindling traffic and declining revenues. These malls are having difficulty competing with online giant Amazon (AMZN).

Consumers now prefer to shop online because of the convenience of shopping anywhere and anytime. Retailers are closing their stores in order to maintain their profits, and the malls are left vacant. However, office space leases have grown in recent months, backed by the American economy’s recent growth spurt. This economic improvement triggered growth in the revenues of REITs like Vornado Realty Trust (VNO).

President Trump’s pro-American policies and the recent improvement in jobs data also led to improved business in Class A cities like New York City.

Lower revenues ahead

Driven by aggressive acquisitions and locational advantage, Vornado Realty Trust (VNO)is expected to maintain its leading position in the commercial REIT space. The high barrier to entry in these markets could provide the company with a stable premium customer base that it feels could improve its profitability.

However, the company is facing lower revenues due to a sell-off its assets as part of its strategy to concentrate on Class A cities and their surrounding vicinities.

Vornado Realty Trust (VNO) is in talks to finalize the tax-free spinoff of its business in Washington, D.C. VNO expects to concentrate solely on its New York business after the spinoff.

Vornado had previously spun off its shopping center business into a public company named Urban Edge. These streamlining efforts have helped the company improve its core business, although it poses near-term headwinds.

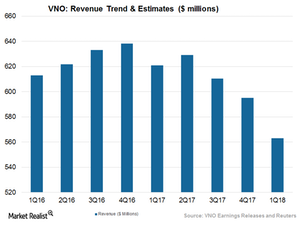

Analysts are not very optimistic about the company’s future top-line prospects. Although its revenues are expected to rise 1.2% in 2Q17, they are expected to fall 3.6%, 6.8%, 9.3%, and 5.5% in 3Q17, 4Q17, 1Q18, and 2Q18, respectively, on a year-over-year basis.

Vornado reported a five-year compound annual decline rate of 3%. Among its close competitors, AvalonBay Communities (AVB), Equity Residential (EQR), and Boston Properties (BXP) reported five-year compound annual growth rates of 16.1%, 8.6%, and 4.1%, respectively.

Vornado, Boston Properties, and Equity Residential comprise ~12.4% of the iShares Cohen & Steers REIT ETF (ICF). ICF’s portfolio is broadly diversified and provides a cushion against industrial and macroeconomic headwinds and volatility.

Top-line performance in 1Q17

For 1Q17, however, Vornado reported year-over-year growth in its top line, backed by higher same-store leases. The company reported a top line of ~$620.9 million, up 1.3% year-over-year. However, its revenues missed analyst estimates by 2.2%.

During 1Q17, Vornado had leased 552,700 square feet of office space in the state of New York and 12,400 square feet of retail space in New York City.

Same-store revenues in the New York office properties gained almost 15.9%, backed by higher leases. Occupancy rose 90 basis points to 96.7% during the quarter. New York retail occupancy, however, fell 80 basis points to 95.3%.

At TheMart, Vornado leased 100,300 square feet of retail space. At 55 California Street in San Francisco, the company leased 66,300 square feet during the quarter. In its Washington, D.C., business, which is scheduled to be spun off very soon, Vornado leased 545,000 square feet of space and reported 90.2% occupancy during the quarter.

In the next article, we’ll delve into the growth strategies taken by Vornado.