Will General Mills Sustain Its Sales Momentum in Q3?

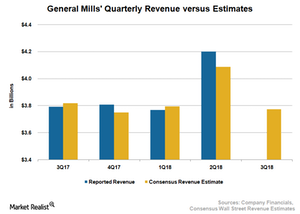

Analysts expect General Mills (GIS) to report sales of $3.8 billion in fiscal 3Q18, reflecting a marginal decline of 0.5% on a YoY (year-over-year) basis.

March 13 2018, Updated 4:50 p.m. ET

Analysts expect sales to decline

Analysts expect General Mills (GIS) to report sales of $3.8 billion in fiscal 3Q18, reflecting a marginal decline of 0.5% on a YoY (year-over-year) basis. Analysts expect continued sluggishness in yogurt sales to weigh on its top-line performance in fiscal 3Q18. Notably, General Mills’ sales returned to growth during the last reported quarter (fiscal 2Q18) after marking a decline in the past nine quarters.

Factors to impact General Mills’ sales

General Mills’ top line could benefit from improved sales of cereals, snacks, and frozen meals, driven by growth in new products. The company’s new products—including Chocolate Peanut Butter Cheerios and Oui by Yoplait—are seeing healthy demand. Plus, fruit snacks and Lärabarand Nature Valley snack bars are also expected to sustain their growth momentum in Q3.

However, continued sluggishness in the Yogurt division, tight inventory management by retailers, and overall weak demand for packaged food in the United States are expected to remain a drag.

The consumer shift toward healthy and fresh food continues to affect the top-line performance of packaged food manufacturers in the United States. Meanwhile, the price war among retailers further pressures top-line growth. For instance, Hershey (HSY) and Kraft Heinz (KHC) saw lower volumes during the last reported quarter, which adversely impacted their sales growth rates.

However, the focus on innovative new product launches, improved product mix, and incremental sales from fast-growing acquired brands are driving sales for these food manufacturers. Mondelēz (MDLZ), J. M. Smucker (SJM), and Kellogg (K) reported improved sales performance during the last reported quarter. Meanwhile, analysts expect Conagra Brands’ (CAG) top line to improve on a YoY basis in fiscal 3Q18.