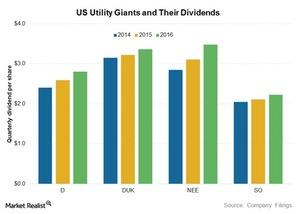

D, DUK, NEE, and SO: Top Utilities’ Dividends

Dominion Resources (D) paid annual dividends of $2.80 in 2016. Duke Energy (DUK) paid dividends of $3.36 per share last year.

Nov. 20 2020, Updated 4:26 p.m. ET

Top utilities and their dividend payments

Dominion Resources (D) paid annual dividends of $2.80 in 2016. Duke Energy (DUK) paid dividends of $3.36 per share last year. In comparison, peers NextEra Energy (NEE) paid $3.48 per share, while Southern Company (SO) paid annual dividends of $2.22 per share last year.

Among the four companies, NextEra Energy’s dividends grew remarkably in the last few years due to strong earnings growth. According to analysts’ estimates, NextEra Energy’s dividends are expected to increase more than 10% due to its strong earnings growth for the next few years.

Dominion Resources’ dividends are expected to grow 8% annually, while Southern Company and Duke’s dividends are expected to grow ~5% in the next few years.