Consumer Discretionary: Which Are the Top Dividend Growers?

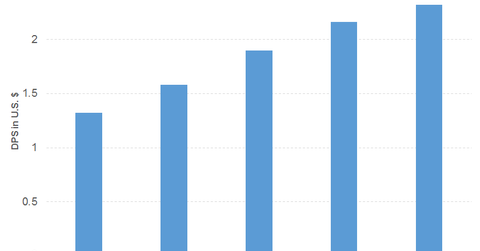

Consumer Discretionary Select Index sales, earnings, and dividends have grown at a CAGR (compound annual growth rate) of 6%, 7.2%, and 10.7%, respectively between 2012 and 2017.

July 12 2017, Published 2:44 p.m. ET

The top consumer discretionary dividend growers

Consumer Discretionary Select Index sales, earnings, and dividends have grown at a CAGR (compound annual growth rate) of 6%, 7.2%, and 10.7%, respectively between 2012 and 2017. The sector has been driven by the spending of e-commerce giants and retailers (excluding automobile retailers). Tax policies and the response to the Amazon threat will play an important role for this sector going forward.

Target

Although Target has (TGT) has seen a rising trend in revenue since fiscal 2007, it recorded a fall of ~6% in fiscal 2016 due to a weakness in comparable sales. Lower traffic and rising e-commerce popularity played an important role in the decline.

However, lower operating expenses helped it posting growth in operating income and EPS (earnings per shares). The weakness continued in 1Q17, with a decrease in intensity. A decrease in operating expenses translated into growth in EPS. The discount and variety store company has generated enough free cash flow to honor its dividend obligations in the last five years and 1Q17, and it has a strong cash position. However, Target has a higher debt-equity ratio than Costco Wholesale (COST), and its stock price has plummeted by 29.3% YTD (year-to-date). The company has focused on restructuring its stores and brands to draw more traffic. It has also concentrated towards buttressing the position of its e-commerce.

Target’s PE ratio is 11.1x, compared with the sector average of 20x. Its dividend yield of 4.9% has beaten the sector average of 2.4%. Costco Wholesale offers a dividend yield of 1.3% at a PE ratio of 28.9x. Target had a dividend payout ratio of 42.1% in fiscal 2016, whereas Costco’s ratio was 31.2%.

Genuine Parts

Genuine Parts (GPC) has consistently grown its revenue since fiscal 2010, except a minor decline in fiscal 2015. However, automakers and auto part producers are now seeing flattening sales after a sharp rise. The decline in operating income in fiscal 2016 was driven by higher operating expenses as competition increased, leading to a slight decline in EPS growth. The auto parts wholesaler reported growth in revenue in 1Q17, driven by all its segments, boosting its operating income and EPS. The company has generated enough free cash flow in the last five years to pay off its dividends, except in 1Q17. It usually maintains a reasonable cash balance and has a very low debt-to-equity ratio. The company is engaging in strategic acquisitions, introducing new product lines, and exploring new markets to drive its revenue and earnings.

Its stock price has plummeted 9.1% YTD. Genuine Parts has a PE ratio of 18.9x, against the sector average of 20.2x. It has a dividend yield of 3.1%. Genuine Parts recorded a dividend payout ratio of 55.9% in fiscal 2016.