How Alcoa Fared in 4Q17

While Alcoa’s 4Q17 earnings rose sharply as compared to previous quarters, the quarterly results fell short of expectations.

Jan. 18 2018, Updated 7:36 a.m. ET

Alcoa’s 4Q17 earnings

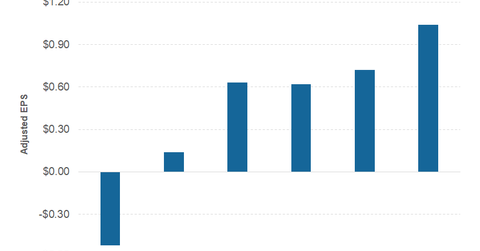

Alcoa (AA) reported its 4Q17 earnings on January 17 after the markets closed. The company reported adjusted net income of $195 million in 4Q17, which translates into adjusted EPS (earnings per share) of $1.04. In comparison, it posted adjusted EPS of $0.72 in 3Q17 and $0.14 in 4Q16. While Alcoa’s 4Q17 earnings rose sharply as compared to the previous quarters and 4Q17 was the best quarter that the company has reported since its independent listing in 2016, the results fell short of expectations. Alcoa was down 6.6% in after-hours on January 17.

Earnings season

South32 (S32) also released its December quarter production on January 17. Other aluminum producers (XME) like Norsk Hydro (NHY) and Century Aluminum (CENX) are also expected to release their quarterly financial results as the earnings season progresses. Alumina Limited (AWC) is scheduled to release its 2017 full-year results on February 22.

Alcoa had a strong 2017 and the stock gained 91.2% last year. The rise was supported by aluminum prices, which rose 32.9% last year. The stock continued its good run in 2018 and based on January 17 closing prices, Alcoa was trading with year-to-date gains of 5.8%.

Series overview

In this series, we’ll analyze Alcoa’s 4Q17 earnings and its performance on some key financial metrics. Finally, we’ll look at Alcoa’s 2018 guidance and see what Alcoa’s management had to say about the company’s outlook during its 4Q17 earnings call.