How US Utility Stocks Are Valued for the New Year

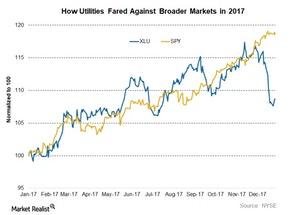

US utilities have corrected notably over the past few weeks, and their recent valuations could start attracting new entrants.

Jan. 2 2018, Updated 7:39 p.m. ET

Utility valuations

US utilities have corrected notably over the past few weeks, and their recent valuations could start attracting new entrants. On December 29, 2017, broader utilities were trading at an EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) valuation of ~10.5x. Their five-year historical valuation average is near 9x.

Among the top utilities, NextEra Energy (NEE), the utility with the highest weight in S&P 500 Utilities Index, is currently trading at an EV-to-EBITDA valuation of 13.3x, compared with its five-year historical average of 12x. Thus, NEE seems to be trading at a fair premium, when compared with industry average as well as with its historical average.

Duke Energy (DUK), the second-largest utility by market capitalization, is currently trading at a valuation multiple of 12x. Southern Company (SO) stock seems to be trading at a comparatively fair valuation relative to peers. It has a valuation multiple of 11x—close to its five-year historical valuation.

Utilities appear to be trading at a premium based on their PE (price-to-earnings) ratios as well. On average, they have a PE multiple of 16x, compared with their five-year average of around 14x–15x. NextEra Energy and Southern Company have their PE ratios near 18x while Duke Energy is trading at a PE multiple of ~21x.