Understanding Home Depot’s Dividend Policy

In the first three quarters of 2017, Home Depot (HD) paid dividends of $0.89 per share. In 3Q17, it paid dividends at a payout ratio of 48.2%.

Jan. 22 2018, Updated 10:32 a.m. ET

The importance of dividends

Dividends smooth out return volatility, which is more important in cyclic companies such as home improvement retailers. The sales of home improvement companies are highly sensitive to the performance of the economy and other macro factors.

Home Depot’s dividends

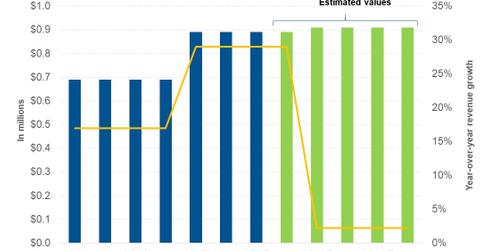

In the first three quarters of 2017, Home Depot (HD) paid dividends of $0.89 per share. In 3Q17, the company had paid dividends at a payout ratio of 48.2%. The company’s dividend yield stood at 1.8% as of January 17, 2018.

On the same day, the dividend yield of Lowe’s Companies (LOW), Williams-Sonoma (WSM), and Bed Bath & Beyond (BBBY) stood at 1.61%, 2.87%, and 2.46%, respectively.

Analysts are expecting Home Depot to pay a dividend of $0.89 in fiscal 4Q17, which would take the total for fiscal 2017 to $3.56 and would represent a rise of 29.0% from $2.76 in fiscal 2016. For fiscal 2018, analysts expect the company to pay dividends totaling $3.64, which would represent a YoY (year-over-year) rise of 2.2%.

Share repurchases

Apart from paying dividends, Home Depot also rewards its investors with share repurchases. In the first three quarters of 2017, the company repurchased shares worth $5.9 billion, and the company’s management expects to repurchase shares worth $2.1 billion in fiscal 4Q17.

On December 6, 2017, Home Depot announced a new $15-billion share repurchase program. In the next three years, the company expects to repurchase shares worth $12.5 billion.

In the next part, we’ll assess Home Depot’s analyst recommendations.