Reading Key Mining Stock Technicals as of December

Most of the mining companies have increased during the past two weeks due to the rise of gold and silver.

Jan. 5 2018, Updated 9:03 a.m. ET

Mining shares

Most of the mining companies have increased during the past two weeks due to the rise of gold and silver. The mining companies below all closely watch the movements in precious metals rather than the equities market in general.

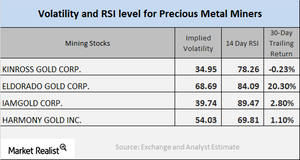

For our analysis here, we’ve selected Kinross Gold (KGC), Eldorado Gold (EGO), Iamgold (IAG), and Harmony Gold (HMY). All four of these miners except Kinross have risen on a 30-day trailing basis. Kinross has seen a marginal 30-day loss of 0.23%, while EGO, IAG, and HMY have risen 20.3%, 2.8%, and 1.1%, respectively.

Volatility analysis

KGC, EGO, IAG, and HMY have call-implied volatilities of 35%, 68.7%, 39.7%, and 54%, respectively. Remember, call-implied volatility measures the changes in an asset’s price given the changes in its call option.

RSI readings

When a stock’s RSI level is greater than 70, it indicates that it could be in overbought territory, and so the stock’s price could fall. When a stock’s RSI indicator is less than 30, however, it indicates that the stock could be oversold, and so its price could rise. KGC, EGO, IAG, and HMY have RSI levels of 78.3, 84.1, 89.5, and 69.8, respectively.

Notably, our two key mining-based funds, the Sprott Gold Miners (SGDM) and the Global X Silver Miners Fund (SIL), have risen 4.1% and 4.4%, respectively, on a 30-day trailing basis as of December 27. Remember, movements in precious metals are crucial to these mining-based funds.

Continue to the next and final part for a look at the recent stock movements among key mining stocks and funds.