Oil Inventory Data Could Push Oil Higher

In the week ending January 5, 2018, US crude oil inventories fell by 4.9 MMbbls (million barrels)—1 MMbbls more than the market’s expected fall.

Jan. 16 2018, Updated 11:30 a.m. ET

Oil inventory data

In the week ending January 5, 2018, US crude oil inventories fell by 4.9 MMbbls (million barrels)—1 MMbbls more than the market’s expected fall. US crude oil inventories were at 419.5 MMbbls for the same week. The EIA (U.S. Energy Information Administration) released the data on January 10. On the same day, US crude oil prices rose 1%.

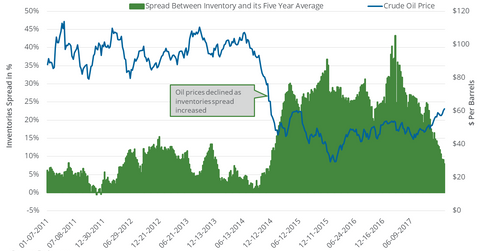

Inventories spread

The inventories spread represents the difference between US crude oil inventories and their five-year average. In the week ending January 5, 2018, the inventories spread fell by 1.1 percentage points to 8% on a weekly basis. It would have helped push oil prices higher after the release of the inventory data on January 10. Since January 10, 2018, US crude oil (DBO) (OIIL) (USL) prices have risen 1.1%.

Oil (UCO) (BNO) prices and the inventories spread tend to move in opposing directions. The inventories spread rose to ~25% in the week ending September 15, 2017. Since then, the inventories spread has fallen by ~17 percentage points. During this period, US crude oil rose 28.9%.

Inventories level

Any increase in US crude oil inventories below 838,000 barrels for the week ending January 12, 2018, would reduce the inventories spread. So, US crude oil inventories should be below 420.35 MMbbls for the same week for the spread to fall more. A drop in inventories would be bullish for prices. The EIA will release US crude oil inventory data on January 18, 2018.