Oil ETFs: How They’re Performing at Oil’s 3-Year High

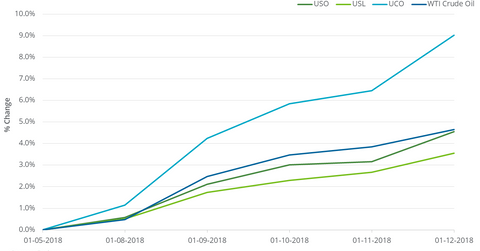

Between January 5 and January 12, 2018, the United States Oil ETF (USO), which holds positions in US crude oil active futures, gained 4.5%.

Jan. 17 2018, Updated 7:34 a.m. ET

Oil ETFs

Between January 5 and January 12, 2018, the United States Oil ETF (USO), which holds positions in US crude oil active futures, gained 4.5%. That was 20 basis points less than the rise in US crude oil futures that week. On January 12, US crude oil futures closed at $64.30 per barrel, their highest closing level since December 8, 2014.

The United States 12 Month Oil ETF (USL), which holds positions in US crude oil futures contracts until January 2019, rose 3.6% in the week ended January 12, 2018. That week, the ProShares Ultra Bloomberg Crude Oil ETF (UCO) gained 9%, matching its objective to capture twice the daily fluctuations of the Bloomberg WTI (West Texas Intermediate) Crude Oil Subindex.

Performance since 2016

Between February 11, 2016, and January 12, 2018, US crude oil (DBO) (OIIL) active futures rose 145.3% from their 12-year low. USO, USL, and UCO rose 61%, 55.9%, and 105.5%, respectively, from oil’s $26.21 per barrel closing level on February 11, 2016.

Investors should note that US crude oil futures’ roll yield could be behind the smaller returns of these ETFs compared to oil prices. When active futures settle below the next month’s futures, these ETFs could incur losses. Additionally, the compounding effect of daily price changes could make UCO’s actual returns different than its expected returns.

On January 12, 2018, US crude oil futures contracts between February 2018 and January 2019 settled progressively lower. Some believe these ETFs could benefit from this structure.