Which Oil ETFs Might Be a Better Bet in 2018?

On December 29, 2017, the closing prices of US crude oil futures contracts between March 2018 and January 2019 were progressively lower.

Jan. 3 2018, Updated 10:25 a.m. ET

Oil ETFs

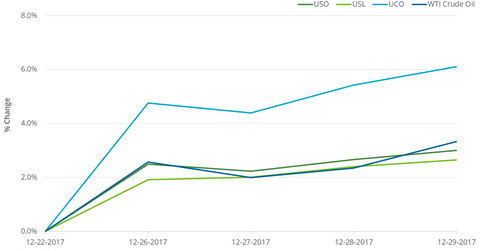

On December 22–29, the United States Oil Fund (USO), which holds US crude oil futures, rose 3%. USO’s rise was 30 basis points less than the rise in US crude oil February futures during this period.

The United States 12-Month Oil Fund ETF (USL), which holds US crude oil futures contracts between February 2018 and January 2019, rose 2.6% last week. During this period, the ProShares Ultra Bloomberg Crude Oil ETF (UCO) rose 6.1%. Its objective is to match twice the daily changes of the Bloomberg WTI Crude Oil Subindex. So, UCO might be the best bet for any possible upside in oil prices in 2018.

February 2016

Between February 11, 2016, and December 29, 2017, US crude oil (DBO) (OIIL) active futures rose 127.5%. US crude oil (OIIL) (DBO) active futures closed at $26.21 per barrel on February 11, 2016—the lowest closing price in 12 years. USO, USL, and UCO rose 49.1%, 46.4%, and 77.4%, respectively, from this date.

The difference in ETFs’ returns compared to oil might be due to active futures trading less than next month’s futures or the negative roll yield.

On December 29, 2017, the closing prices of US crude oil futures contracts between March 2018 and January 2019 were progressively lower. It might help these ETFs gain more.

In UCO’s case, the actual and expected returns could be different due to the impact of daily price changes.