How Is Novo Nordisk’s New Generation Insulin Segment Positioned after 3Q17?

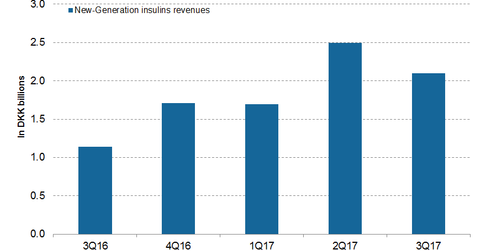

In 3Q17, Novo Nordisk’s (NVO) new generation insulin generated revenues of 2.1 billion Danish krone (or DKK), which reflected ~93% growth on a year-over-year (or YoY) basis.

Jan. 4 2018, Updated 4:35 p.m. ET

New generation insulin revenue trends

In 3Q17, Novo Nordisk’s (NVO) new generation insulin generated revenues of 2.1 billion Danish krone (or DKK), which reflected ~93% growth on a year-over-year (or YoY) basis. In 3Q17, in the US, Europe, AAMEO (Africa, Asia, Middle East and Oceania), Japan & Korea, and Latin America, new generation insulin saw revenues of 1.1 billion DKK, 435 million DKK, 125 million DKK, 246 million DKK, and 107 million DKK, respectively.

Novo Nordisk’s new-generation insulin reported revenues for the first nine months of 2017 (or 9M17) of DKK 6.3 billion. In the US, Europe, AAMEO, Japan & Korea, and Latin America, new generation insulin generated 9M17 revenues of 3.7 billion DKK, 1.2 billion DKK, 307 million DKK, 712 million DKK, and 290 million DKK, respectively.

Tresiba revenue trends

Tresiba (insulin degludec), a long-acting insulin analog, is used for the treatment of individuals with diabetes mellitus. Tresiba is not advised for the treatment of diabetic ketoacidosis or for pediatric patients who require less than five units of Tresiba.

Tresiba reported 9M17 revenues of DKK 5.4 billion, which reflected ~118% growth on a YoY basis. In the US, Europe, AAMEO, Japan & Korea, and Latin America, Tresiba reported 9M17 revenues of 3.7 billion DKK, 717 million DKK, 184 million DKK, 540 million DKK, and 269 million DKK, respectively.

In December 2017 at the International Diabetes Federation (or IDF) Annual Congress in Abu Dhabi, Novo Nordisk presented data from new analysis of SWITCH one and two trials, which demonstrated that candidates with type one or type two diabetes when treated with Tresiba showed fewer episodes of hypoglycemia (low blood sugar) compared to patients on insulin glargine U100 regardless of whether they achieved blood sugar targets.

Novo Nordisk’s long-acting insulin competes with Sanofi’s (SNY) Lantus and Toujeo, and Eli Lilly’s (LLY) Basaglar. The revenue growth of Novo Nordisk’s new generation insulin could boost the Vanguard FTSE Europe ETF (VGK). VGK invests ~2.0%, 1.0%, and 0.95% of its total portfolio holdings in Novartis (NVS), Sanofi (SNY), and Novo Nordisk, all distinguished players in the diabetes care market.