How Much Fall in Inventories Could Support Oil This Week?

In the week ended December 22, 2017, US crude oil inventories were 431.9 MMbbls (million barrels), a fall of 4.6 MMbbls compared to the previous week.

Jan. 2 2018, Updated 1:30 p.m. ET

EIA inventory report

In the week ended December 22, 2017, US crude oil inventories were 431.9 MMbbls (million barrels), a fall of 4.6 MMbbls compared to the previous week. The figure was based on the EIA’s (U.S. Energy Information Administration) report on December 28, 2017. That same day, US crude oil prices rose 0.3%.

Inventories spread

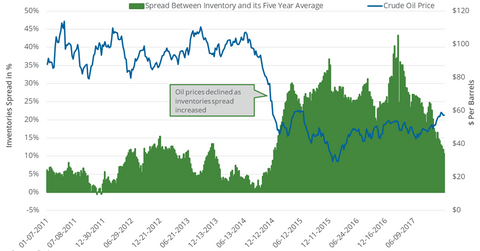

The spread between US oil inventories and their five-year average, or the inventories spread, is important for oil prices. Usually, oil prices move opposite to the inventories spread. That means a fall in the inventories spread could help oil (UCO) (BNO) prices rise.

In the week ended December 22, 2017, the inventories spread was 9.2%, or 1.5 percentage points lower than the previous week. After the inventory data on December 28, 2017, US crude oil (OIIL) (USL) (DBO) futures rose 1% to date.

What oil traders should expect

In the week ended December 29, 2017, US crude oil inventories would have to fall 6.9 MMbbls in order for the inventories spread to narrow and support oil prices. On January 4, 2018, the EIA will release its oil inventory report. In the next part, we’ll take a look at the US crude oil futures spread.