A Look at AT&T’s Earnings Margins

AT&T’s earnings growth in 4Q17 Previously, we discussed how much revenue growth we can expect from AT&T (T) in 4Q17. In this part, we’ll look at AT&T’s expected domestic wireless operations EBITDA (earnings before interest, tax, depreciation, and amortization). Wall Street analysts forecast AT&T’s combined domestic wireless operations EBITDA to rise ~3.2% YoY (year-over-year) to ~$6.9 […]

Aug. 18 2020, Updated 5:34 a.m. ET

AT&T’s earnings growth in 4Q17

Previously, we discussed how much revenue growth we can expect from AT&T (T) in 4Q17. In this part, we’ll look at AT&T’s expected domestic wireless operations EBITDA (earnings before interest, tax, depreciation, and amortization). Wall Street analysts forecast AT&T’s combined domestic wireless operations EBITDA to rise ~3.2% YoY (year-over-year) to ~$6.9 billion in 4Q17.

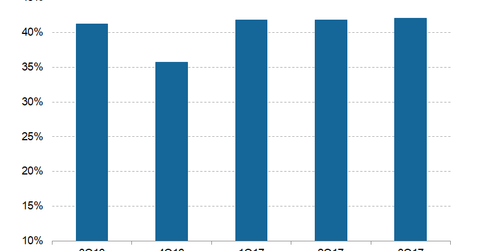

In comparison, this figure stood at $7.3 billion in 3Q17 and $7.5 billion in 3Q16. AT&T’s combined domestic wireless operations EBITDA margin improved from 41.2% in 3Q16 to 42.0% in 3Q17, its best-ever EBITDA margin, according to the company. Despite the traditional US wireless market being as intense as ever, the telecom company was able to increase its EBITDA margin due to strong cost management and customer retention.

Peer comparison: EBITDA margins in 3Q17

In calendar 3Q17, Sprint (S) and Verizon (VZ) reported consolidated adjusted EBITDA margins of 45.7% and 36.7%, respectively. Meanwhile, T-Mobile’s (TMUS) adjusted EBITDA margin was 37.0%. Sprint is enjoying a wider margin than peers due to significant cost reductions and higher equipment contribution. In the next part, we’ll take a look at AT&T’s expected postpaid phone customer net additions in 4Q17.