What Investors Need to Know about MLPs

MLPs are engaged in the production, transportation, storage, and processing of natural resources like oil, natural gas, and NGLs. They’re public companies.

April 9 2015, Published 11:26 a.m. ET

Overview of MLPs

MLPs (master limited partnerships) are engaged in the production, transportation, storage, and processing of natural resources like oil, natural gas, and NGLs (natural gas liquids). They don’t pay income tax at the partnership, or company, level. Unlike most partnerships, MLPs are public companies. They trade on the major stock exchanges and file documents like 10-Ks and 10-Qs. They also report material changes with the SEC (U.S. Securities and Exchange Commission).

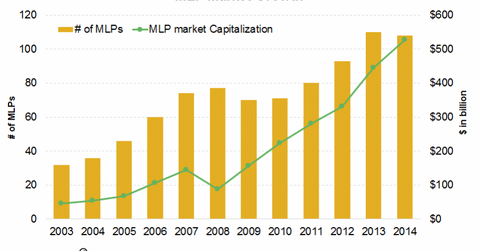

The number of MLPs increased from 32 in 2003 to 108 as of April 30, 2014. The above graph shows a dip in the number of MLPs during the financial crisis. This was due to the weaker economic environment, low crude oil prices, slump in drilling activity, and fall in energy consumption.

According to the IRS (Internal Revenue Service), to operate as MLPs at least 90% of the revenue must come from qualified services. The services include:

- natural resource activities

- interest, dividends, rental income, and capital gains from real estate properties

- income from commodity investments

For more details about qualified income, refer to Section 7704(d)(1) of the Internal Revenue Code.

Investment options

Generally, MLPs pay out a majority of their cash flows to investors as distributions. Investors interested in regular income investments can invest in MLPs by buying MLP stocks like Enterprise Products Partners (EPD), Energy Transfer Partners LP (ETP), and Williams Partners LP (WPZ). They can also invest through funds tracking a broader portfolio of MLPs like the Alerian MLP ETF (AMLP) and the First Trust North American Energy Infrastructure Fund (EMLP). We’ll cover the other methods of investing in MLPs later in this series.