Why Did Harley-Davidson Cut Jobs?

Harley-Davidson rose by 0.36% to close at $52.89 per share on September 1, 2016. Its weekly, monthly, and YTD price movements were -0.66%, 2.4%, and 18.5%.

Sept. 2 2016, Published 1:27 p.m. ET

Price movement

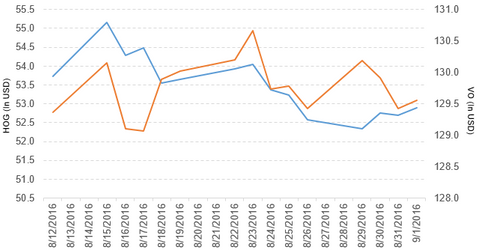

Harley-Davidson (HOG) has a market cap of $9.6 billion. It rose by 0.36% to close at $52.89 per share on September 1, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were -0.66%, 2.4%, and 18.5%, respectively, on the same day.

HOG is now trading 1.2% below its 20-day moving average, 4.6% above its 50-day moving average, and 14.2% above its 200-day moving average.

Related ETFs and peers

The Vanguard Mid-Cap ETF (VO) invests 0.27% of its holdings in Harley-Davidson. VO tracks the CRSP US Mid-Cap Index, a diversified index of mid-cap US companies. VO’s YTD price movement was 8.5% on September 1.

The Vanguard Large-Cap ETF (VV) invests 0.04% of its holdings in Harley-Davidson. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market.

The market caps of Harley-Davidson’s competitors are as follows:

Latest news on Harley-Davidson

In a press release on September 1, 2016, Reuters reported that “Harley-Davidson (HOG) plans to cut about 200 positions as the company adjusts its production schedule due to a lower forecast for motorcycle shipments in 2016.”

It also noted the following: “Harley said of the 200 eliminated positions, about 115 are union jobs at its York Vehicle Operations plant in Pennsylvania, which assembles cruiser models, including the Touring, Softail, and Trike.”

Performance in 2Q16

Harley-Davidson reported 2Q16 motorcycles and related product revenues of ~$1.7 billion, which is a rise of 1.2% from the $1.65 billion it reported in 2Q15. The company’s retail sales in the United States and Latin America fell by 5.2% and 5.0%, respectively, over 2Q15. Its retail sales in Canada, EMEA (Europe, the Middle East, and Africa), and Asia-Pacific rose by 2.0%, 8.2%, and 0.75%, respectively, between 2Q15 and 2Q16.

Harley-Davidson’s financial services revenue came to $191 million in 2Q16, which is a rise of 10% over the same period last year. The company’s gross profits and operating income from motorcycles and related products fell by 7.2% and 10.9%, respectively, between 2Q15 and 2Q16.

Its net income fell to $280.4 million, and its EPS (earnings per share) rose to $1.55 in 1Q16, as compared to $299.8 million and $1.44, respectively, in 1Q15. Harley-Davidson’s cash and cash equivalents and finance receivables both rose by 19.7%, respectively, and its inventories fell by 36.6% between 4Q15 and 1Q16. Its current ratio rose to 1.7x in 1Q16 from 1.4x in 4Q15. It reported a long-term debt-to-equity ratio of 2.6x in both 4Q15 and 1Q16.

Quarterly dividend and projections

Harley-Davidson has declared a quarterly cash dividend of $0.35 per share on its common stock. The dividend will be paid on September 23, 2016, to shareholders of record on September 13, 2016.

The company has made the following projections for 2016:

- motorcycle shipments of 264,000—269,000, which is a rise of approximately -1%—1% from 2015

- an operating margin of ~15%–16% for the Motorcycles segment

- capital expenditure of $255 million–$275 million

- an effective tax rate of ~33%

The company has projected motorcycle shipments of 49,000–54,000 for 3Q16.

In the next part of this series, we’ll discuss Sonoco Products (SON).