Is Gold Keeping Tabs on the US Interest Rate?

As we know, precious metals are closely tied to movements in US interest rates. Bonds and equities are both yield-bearing assets, so a rise in yields often causes a slump in demand for assets such as gold and silver.

Jan. 24 2018, Updated 9:38 a.m. ET

Non-interest-bearing assets

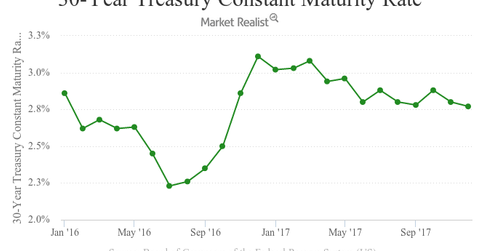

As we know, precious metals are closely tied to movements in US interest rates. Bonds and equities are both yield-bearing assets, so a rise in yields often causes a slump in demand for assets such as gold and silver, which don’t bear any intermediary cash flows. The 10-Year US Treasury Yield (IEF) has hit its highest point since March 2017 at 2.6%. There’s a chance that this rise could leave a negative impact on gold and other precious metals going forward.

When the Federal Reserve lifted the interest rate for the first time in a decade in December 2015, precious metals prices slumped. Gold and silver funds, including mining funds (SGDM), also retreated. The same was the case for the mining companies.

[marketrealist-chart id=2554583]

View of the Fed

There has been speculation in the market that the FOMC (Federal Open Market Committee) will raise the interest rate three or four times in both 2018 and 2019. This was also the view taken by the Cleveland Federal Reserve Bank’s president, Loretta Mester, on January 18, 2018.

The consumer sentiment metric that came out on January 19 was 94.4, lower than analysts’ expectation of 97. Consumer sentiment data measure the level of a composite index based on surveyed consumers. The higher the number, the better the forecast is for the economy.

Among the mining shares that retreated on January 19 despite the rise in the prices of the precious metals are Wheaton Precious Metals (SLW), Franco-Nevada (FNV), Alacer Gold (ASR), and Harmony Gold (HMY). These stocks fell 1.5%, 3%, 0.44%, and 1.2%, respectively.